Chemicals Industry Today

Base Oil Prices Q2 2025 – Latest Trends, Index & Historical Data

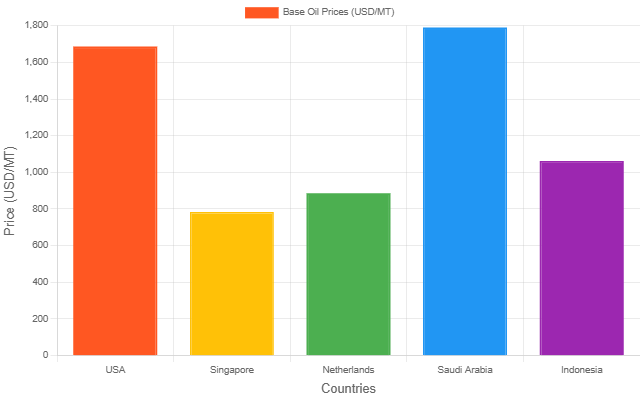

The Base Oil Price Historical Data a detailed analysis of market movements, regional pricing data, and predictive insights for businesses, traders, and procurement teams. The report highlights price fluctuations, market drivers, and regional comparisons with a focus on the Base Oil prices across key markets including the USA, Singapore, Netherlands, Saudi Arabia, and Indonesia. For in-depth price charts, indexes, and projections, you can explore the full report on IMARC’s website.

Base Oil Price Trend Analysis 2025

During the second quarter of 2025, Base Oil prices showcased significant volatility influenced by crude oil benchmarks and supply chain constraints. In March 2025, prices in the USA stood at US$ 1686/MT, while Singapore and the Netherlands saw rates of US$ 783/MT and US$ 885/MT respectively. The Middle East, particularly Saudi Arabia, recorded higher prices at US$ 1790/MT due to refinery overheads. This trend reflects a broader shift impacted by tightening inventories and transportation hurdles.

Base Oil Forecast 2025 - Beyond

The Base Oil future price is expected to show moderate growth in the near term, driven by rebounding industrial demand and geopolitical stability. Looking ahead to late 2025 and early 2026, prices are likely to rise marginally in Asia and the Middle East as infrastructure investments continue. North American markets may see seasonal dips depending on automotive lubricant demand and domestic refinery outputs.

Get Real-Time Price Analysis: https://www.imarcgroup.com/base-oil-pricing-report/requestsample

Base Oil Price Chart & Index Data

Our Base Oil price index offers real-time and historical views of price movements across global regions. The chart includes monthly and quarterly updates, highlighting significant inflection points and regional price gaps. The Base Oil price chart shows sharp contrasts between regions like Saudi Arabia and Southeast Asia, driven largely by production costs and logistical dynamics.

Base Oil Price Historical Overview:

In comparison to 2024, Base Oil prices in 2025 have generally shown an upward trajectory, particularly in the U.S. and Saudi Arabia. The Base Oil price history indicates that global recovery post-COVID and shipping constraints in key maritime routes played a significant role in cost increases. Historical data helps predict future cycles and supports strategic procurement planning.

Base Oil Price Comparison: Q1 vs Q2 2025

Quarterly Base Oil Price Movement: Q1 vs Q2 2025

From Q1 to Q2 2025, the Base Oil prices fluctuated across various regions. The USA and Saudi Arabia experienced slight declines of around 2% and 3% respectively, indicating a momentary stabilization. Meanwhile, Singapore and Indonesia saw a drop of approximately 2%–4%, whereas the Netherlands recorded the most significant decline of over 6%, attributed to lower refinery throughput and seasonal demand adjustments.

List of Base Oil Suppliers

Some prominent suppliers of Base Oil globally include:

- SK Lubricants Co., Ltd.

- Chevron Corporation

- PetroChina Company Limited

These suppliers are leading the market with integrated refining capabilities, consistent production output, and wide global distribution.

Factors Influencing Base Oil Prices 2025

Crude Oil Prices: As a petroleum derivative, Base Oil prices are directly linked to crude oil. Volatile crude benchmarks push Base Oil production costs higher.

Supply and Demand: Demand from the automotive and industrial lubricants sectors largely affects the market. Seasonal and economic cycles influence supply dynamics globally.

Refinery Costs: Processing complexity and input costs like hydrogen or additives can raise the price of Base Oil, especially in advanced formulation grades.

Geopolitical Events: Tensions in oil-producing nations or disruptions like the Red Sea crisis can delay shipments and alter price trajectories.

Seasonality: Demand spikes during colder months due to higher lubricant consumption, especially in North America and Europe, raising short-term Base Oil prices.

Recent Base Oil Price Trends and Market Activity

European Market: Europe observed a price softening due to weaker industrial demand and high inventories. Reduced downstream activity also affected purchasing volumes.

North American Market: The USA experienced stable Base Oil prices supported by domestic refining and steady lubricant production. Automotive demand continues to be a price stabilizer.

Impact of Red Sea Disruptions: Shipping route disruptions have caused delays and elevated freight costs, especially for Asian and Middle Eastern suppliers, adding pressure to Base Oil price index.

Demand Fluctuations: End-use industries, particularly the automotive and power generation sectors, are experiencing shifting patterns, directly impacting Base Oil price today.

Producer Price Index (PPI): Rising PPI figures in Q2 2025 have reinforced the cost-push pressure in manufacturing lubricants and additives.

Base Oil Price Index and Regional Variations

US: Stable with slight downtrend in Q2 due to improved refining efficiency.

China: Relatively flat due to local supply sufficiency and controlled imports.

Global: Minor price correction driven by recovery in shipping logistics and fuel input costs.

Base Oil Specific Future Trends and Outlooks

Near Term: Expect a cautious rise in prices globally, as crude oil remains volatile and demand picks up in late 2025.

Long Term: Green energy transitions and the EV market may marginally reduce lubricant demand, but industrial uses will maintain demand for Base Oils.

Historical Trends

2024: Prices were highly volatile due to post-pandemic effects and global inflationary trends.

2025: Prices are showing signs of moderation, with fewer extreme fluctuations and more region-specific adjustments.

News & Recent Development

- June 2025: Refinery expansions in the Middle East may help ease global supply bottlenecks.

- May 2025: US base oil exports rose marginally, improving the trade balance.

- April 2025: Asia-Pacific countries reduce dependency on imports by scaling domestic production.

Browse Here More other Related Reports:

· Fuel Oil Price Historical Data

· Crude Sunflower Oil Price Historical Data

· Toluene Price Historical Data

· White Oil Price Historical Data

· Tall Oil Price Historical Data

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!