IT Industry Today

U.S. Trade Finance Market to Reach USD 14.96 Billion by 2034 with Rising Trade Activity | CAGR 3.5%

Market Overview

The latest market study published by Polaris Market Research titled U.S. Trade Finance Market Size, Share, Trends, Industry Analysis Report By Instrument (Letter of Credit, Supply Chain Financing, Documentary Collections, Receivables Financing/Invoice Discounting, Others), By Service Provider, By Trade, By Industry – Market Forecast, 2025–2034 is designed to provide users with an in-depth understanding of the market. A comprehensive historical analysis of the market is given, along with extensive market forecasts by region/country and subsectors.

The primary objective of this report is to help readers gain insights into U.S. Trade Finance Market size, trends, sales volume, revenue, historical growth, latest developments, and future outlooks. It offers a qualitative and quantitative analysis of leading participants, expansion plans, geographical regions, and share valuations across all regions.

U.S. Trade Finance Market Size

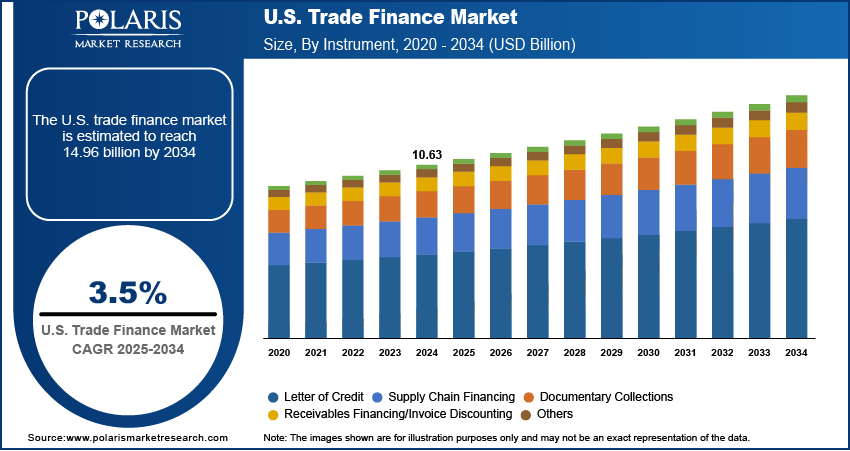

The U.S. trade finance market was valued at USD 10.63 billion in 2024 and is projected to grow at a CAGR of 3.5%, reaching USD 14.96 billion by 2034.

What Is Aim of This Report?

The U.S. trade finance market focuses on domestic and cross-border trade financing solutions provided by banks and financial institutions to support American businesses in importing and exporting goods and services.

The purpose of the market research is to get a thorough understanding of the industry's potential and to offer insights that will help businesses make wise decisions. The study is an essential part of the industry analysis that focuses on key dynamics, SWOT analysis, demand-supply scenario, pricing structure, profit margins, production, and value chain analysis. The report analyzes the unique characteristics and behaviors of each segment that assist users in developing targeted marketing strategies that are tailored to the specific needs and preferences of their customers. The study offers a thorough analysis of the U.S. Trade Finance Market segmentation, including application, product, and service types and several geographic locations.

Get a Sample with the Latest Trends and Future Advancements:

https://www.polarismarketresearch.com/industry-analysis/us-trade-finance-market/request-for-sample

Key Applications:

- Covers domestic and cross-border trade financing for U.S.-based businesses.

- Provides invoice factoring, letters of credit, and supply chain financing solutions.

Benefits:

- Ensures timely and secure payments for trade transactions.

- Reduces financial and operational risks associated with imports and exports.

- Supports SMEs and large corporations in expanding international trade activities.

- Improves competitiveness and market presence of U.S. businesses in global markets.

- Enhances efficiency of supply chains through structured financial solutions.

Market Dynamic Factors

This report lists the various actors that have contributed to the market's upward trajectory. In-depth trends and opportunities in the U.S. Trade Finance Market are highlighted in the analysis. The study report also enables customers to recognize opportunities and difficulties. The research goes on to identify the principal impediments to industry development. Based on the SWOT and Porter's Five Forces models, market dynamics are evaluated, covering the important demand and price variables.

Competitive Landscape Analysis

Another significant portion of this study discusses the competitive landscape of the market. The market's top players are examined in the study. The U.S. Trade Finance Market key players have been described in terms of their key attributes in the information. The section examines their supply chains, potential for growth, U.S. Trade Finance Market share, product portfolio, capacity, cost, revenue, capabilities, expansions, investments, mergers and acquisitions, manufacturer advancements, volume, and clientele. Financial and SWOT analysis contribute to a deeper understanding of the market.

Key Players

- Bank of America Corporation

- BNP Paribas SA

- Citigroup Inc.

- Deutsche Bank AG

- HSBC Holdings plc

- JPMorgan Chase & Co.

- Standard Chartered Bank

- The PNC Financial Services Group, Inc.

- U.S. Bank

- Wells Fargo & Company

To Access the Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase the Complete Report Here.

https://www.polarismarketresearch.com/buy/5398/0

Segment Insights

U.S. Trade Finance Market, Instrument Outlook (Revenue - USD Billion, 2020-2034)

- Letter of Credit

- Supply Chain Financing

- Documentary Collections

- Receivables Financing/Invoice Discounting

- Others

U.S. Trade Finance Market, Service Provider Outlook (Revenue - USD Billion, 2020-2034)

- Banks

- Financial Institutions

- Trading Houses

- Others

U.S. Trade Finance Market, Trade Outlook (Revenue - USD Billion, 2020-2034)

- Domestic

- International

U.S. Trade Finance Market, Industry Outlook (Revenue - USD Billion, 2020-2034)

- BFSI

- Construction

- Wholesale/Retail

- Manufacturing

- Automobile

- Shipping & Logistics

- Others

Browse More Information:

https://www.polarismarketresearch.com/industry-analysis/us-trade-finance-market

The Report Provides You Answer to Below Mentioned Question

Q. What are the U.S. trade finance market statistics?

Ans. The U.S. trade finance market was valued at USD 10.63 billion in 2024 and is projected to grow to USD 14.96 billion by 2034.

Q. What is the growth rate of the U.S. trade finance market?

Ans. The market is projected to register a CAGR of 3.5% during the forecast period.

Q. Who are the key players in the market?

Ans. Some of the key players include BNP Paribas SA, HSBC Holdings plc, JPMorgan Chase & Co., Deutsche Bank AG, Wells Fargo & Company, Citigroup Inc., Bank of America Corporation, and Standard Chartered Bank.

Q. Which segment, by instrument, dominated the U.S. trade finance market revenue share in 2024?

Ans. The letter of credit segment accounted for the largest share of the market in 2024.

Q. Which segment, by service provider, is expected to witness the fastest growth during the forecast period?

Ans. The financial institutions segment is expected to witness the fastest growth during the forecast period.

Report Summary

Moreover, a new task SWOT analysis, a venture attainability investigation, and a venture return analysis are all determined by the study. Overall, the report promises to be a reliable resource for choosing the market research that can boost your company. The study also includes a development strategy for the industry, research findings, an appendix, and a conclusion. It also highlights the most recent advancements in the U.S. Trade Finance Market.

More Related Reports:

Over-The-Top Devices And Services Market

Energy Efficient Buildings Market

Over-The-Top Devices And Services Market

Security Service Edge (SSE) Market

About Polaris Market Research & Consulting, Inc.

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!