IT Industry Today

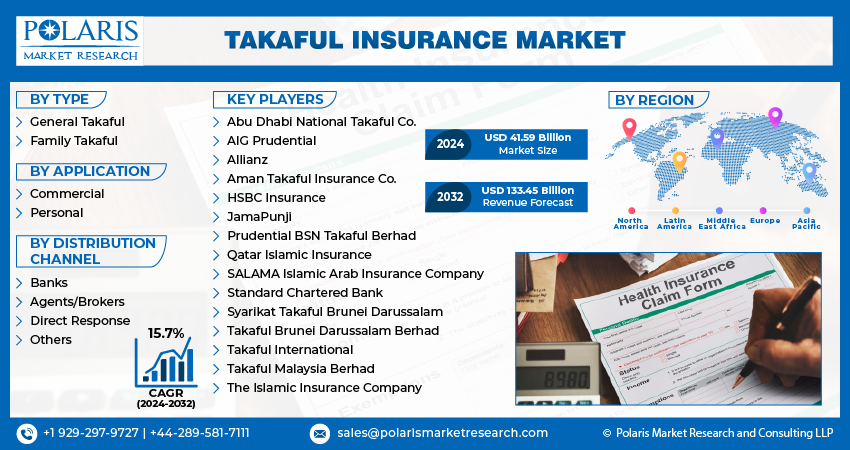

Takaful Insurance Market Size, Shariah-Compliant Finance Trends, and Growth Analysis to Surge to USD 133.45 Billion by 2032 at 15.7% CAGR

Polaris Market Research has announced a report, namely Takaful Insurance Market Share, Size, Trends, Industry Analysis Report By Type (General Takaful, Family Takaful); By Application; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032, that presents a granular analysis of current and future growth status with a detailed analysis of key growth drivers accelerating the market sales globally.

The report provides a detailed analysis of the market status, Takaful Insurance Market size, share, future trends, growth rate, sales channels, and export & import. The report categorizes the market by top players/brands, region, type, and end user. It provides a detailed analysis enclosing business growth opportunities, challenges, and emerging trends.

Takaful Insurance Market Size:

The global takaful insurance market is expanding rapidly as demand for Shariah-compliant financial products rises across Muslim-majority regions and beyond. Valued at USD 36.00 billion in 2023, the market is driven by increasing awareness of Islamic finance principles, supportive government initiatives, and growth in Islamic banking ecosystems. Expansion into health, life, and general insurance segments, coupled with digitalization of insurance services, is expected to fuel a CAGR of 15.7%, with the market projected to reach USD 133.45 billion by 2032.

Get Free Sample PDF Brochure:

https://www.polarismarketresearch.com/industry-analysis/takaful-insurance-market/request-for-sample

Key Market Dynamics

The report deep dives into industry revenue, Takaful Insurance Market demand status, competitive landscape, and CAGR status across all regions. The report is served as a crucial resource for companies planning to chart their future course and establish effective strategies. The report aids companies to gain a thorough analysis of the market, identify customer needs and preferences, and better understand the overall industry.

Market Drivers:

The research offers a comprehensive analysis of trends, drivers, restraints, competitive landscape, and factors that are majorly driving the industry expansion. It elaborates on market dynamics and future trends in this industry. Also, crucial factors that will have a huge influence on the market, i.e., industry news and policies, global rise, and regional conflict, are taken into consideration. The study helps in predicting revenue-boosting prospects in the market. In addition, growth, volume trends, and opportunities in the Takaful Insurance Market are predicted.

Market Restraints:

The report highlights regulatory issues and entry barriers that have a significant effect Takaful Insurance Market growth. It mentions constraints that can become great obstructions to the industry's progress. The report analyzes crucial strategies for seizing opportunities and mitigating risks during the forecast period. This study emphasizes prospective commercial opportunities and assists readers in making knowledgeable business decisions.

Key Benefits for Stakeholders:

- The report estimates the size of the total market opportunity of global and key countries

- Market growth potential is assessed

- The report forecasts future growth in each product and end-user market

- It analyzes competitive factors affecting the marketplace

- This report profiles key players in the market

- Segmentation analysis helps identify current opportunities in the market

- The report provides an in-depth analysis of current trends and dynamics

- The report plots revenue contribution in each geographical region

For Customization Requests, Please Visit:

List of Major Key Players

- Abu Dhabi National Takaful Co.

- AIG Prudential

- Allianz

- Aman Takaful Insurance Co.

- HSBC Insurance

- JamaPunji

- Prudential BSN Takaful Berhad

- Qatar Islamic Insurance

- SALAMA Islamic Arab Insurance Company

- Standard Chartered Bank

- Syarikat Takaful Brunei Darussalam

- Takaful Brunei Darussalam Berhad

- Takaful International

- Takaful Malaysia Berhad

- The Islamic Insurance Company

Competitive Landscape:

For the competitive landscape, the report introduces Takaful Insurance Market key players along with their share, company overview, production, value, product portfolio, gross margin, key developments, and geographical presence. The key companies in this market are engaged in intense competition for a share in terms of innovation, technology, product development, and pricing. Additionally, new Takaful Insurance Market trends, regional conflicts, and mergers and acquisitions will all be taken into account.

Geographic Segment Covered in the Report

The report delivers country-level and regional-level data incorporating the supply and demand strengths that are enhancing the market growth. The section gives information about the market regions, subdivided into sub-regions and countries/regions. In addition, Takaful Insurance Market share in each country and sub-region, along with information on profit opportunities, is estimated and shared in this report.

Browse In-depth Market Research Report:

https://www.polarismarketresearch.com/industry-analysis/takaful-insurance-market

Key Regions Covered in This Report Are

- North America (United States, Canada, and Mexico)

- Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

- Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

- South America (Brazil, Argentina, Colombia, and the rest of South America)

- The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

The report provides a comprehensive supply chain and cost analysis. The performance of the product will be further optimized by technological innovation and improvement, increasing its use in downstream applications. The report looks into the Takaful Insurance Market industrial chain covering crucial upstream raw materials and their suppliers to distributors in the middle and customers in the downstream. The future trends are forecasted from the perspective of different types, applications, and major regions.

Objectives of the Report

- To carefully analyze and forecast the size of the market by value and volume.

- To evaluate the market shares of major segments of the market

- To explain the development of the industry in different parts of the world.

- To analyze and study micro-markets in terms of their contributions to the market, their prospects, and individual growth trends.

- To offer precise and valuable details about factors affecting the Takaful Insurance Market forecasts

- To provide a meticulous assessment of crucial business strategies used by leading companies.

Some of The Key Questions Answered in This Report

Q1. What is takaful insurance?

Ans: Takaful is a Shariah-compliant insurance system based on mutual cooperation, shared responsibility, and risk-sharing principles.

Q2. What factors are driving demand for takaful insurance?

Ans: Rising awareness of Islamic finance, growth in Muslim populations, and supportive regulatory frameworks are key drivers.

Q3. Which takaful segments are growing fastest?

Ans: Family takaful (life and health) and general takaful (motor, property) are experiencing strong growth.

Q4. How is digitalization impacting takaful providers?

Ans: Digital platforms improve policy distribution, customer engagement, claims processing, and operational efficiency.

Q5. What regions show strong adoption of takaful insurance?

Ans: Middle East, Southeast Asia, and parts of Africa are major growth regions due to established Islamic finance ecosystems.

More Related Reports:

Automotive Plastic Compounding Market

Veterinary Sterilization Container Market

About Polaris Market Research & Consulting, Inc.

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!