IT Industry Today

More than $4 Billion Opportunities in the Italy Data Center Market, Google Partnered with TIM, an Italian Telco, for its Cloud Region in Milan - Arizton

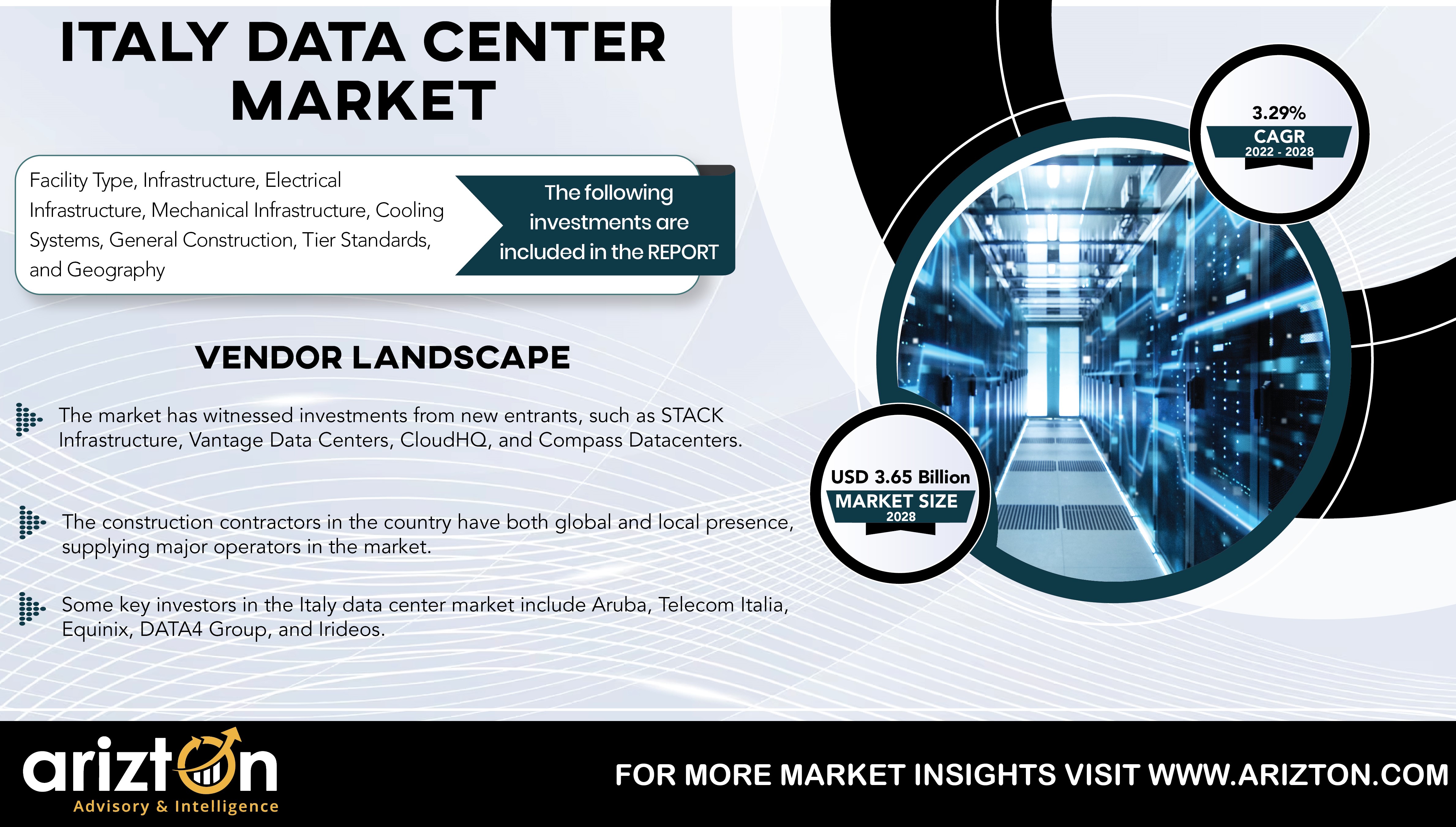

The Italy data center market will grow at a CAGR of 3.29% during the forecast period. The industry is driven by growth in IoT and Big Data technologies, increased 5G deployments, improved digitalized connectivity through submarine cables, and others. Milan is a prominent data center hub in Italy and hosts the country's maximum number of facilities, constituting over 26% of the existing data center area. A strong base of hyperscale operators and colocation data center providers leads Milan.

To Know More, Download the Free Sample Report: https://www.arizton.com/request-sample/3784

Italy is a prominent and emerging data center market in Western Europe. There is a high demand for cloud services from Italian enterprises. In December 2021, the country’s Government allocated around $950 million to develop a national cloud to migrate its workloads carrying sensitive data to the cloud, which will be completed by the end of 2025. Investments in Italy data centers will be driven by submarine cable deployment, cloud migration, 5G deployment, and other digitalization initiatives. The advent of new entrants will provide significant data center investments in the upcoming years.

The increasing demand for cloud services from huge industries has made it a hub for cloud service providers such as Microsoft, Amazon Web Services, and Google. In June 2022, Google partnered with TIM, an Italian telco, and opened a cloud region in Milan. Further, the Italy data center market has a presence of local and global colocation and telecom operators such as Aruba, Equinix, Irideos, Telecom Italia, and SUPERNAP Italia, among others. The growing digitalization and introduction of new submarine cables expand the country’s data center footprint. There are 24 submarine cables and nine upcoming ones, increasing the country’s digital connectivity.

Investment Opportunities in Italy Data Center Market

- Italy is one of the fastest-growing markets among Western European countries. The spike in the global growth in technological adoption during the COVID-19 pandemic resulted in organizations transforming their infrastructure and migrating their workloads with increased investments in data centers.

- The adoption of cloud services; increased connectivity due to submarine cables; and increased technology adoption using AI, Big data, and IoT make Italy a favorable place for data center investments.

- The country experiences immense greenfield construction across its cities. Milan is the prominent data center hub in the country, with the biggest cluster of data centers. The city currently hosts 23 data centers, and nine data centers are in the pipeline.

- Data center providers continuously invest in the country, driven by local enterprises and companies' demand for cloud services. For instance, Vodafone partnered with Microsoft Italy to boost cloud migration and connectivity.

- Italy is connecting itself at a great pace with other countries, digitally aiding in high-speed data transfers catering to the country's digital needs.

- In June 2022, Infratel Italia invested around $49 million in the Piano Isole Minor project to connect 21 islands within Italy through submarine cables as a part of the Strategia Italia 2026 plan.

- In January 2023, the IDA was launched by some colocation and hyperscale data center operators, such as Digital Realty, Vantage Data Centers, Equinix, STACK Infrastructure, and CBRE Data Centers, which will address and monitor the growth of data centers in the region, while also implementing sustainability.

- The country is part of a large-scale mission of the European Union to make 100 smart and carbon-neutral cities by 2030. The European Union selected nine cities in Italy, such as Milan, Bologna, Rome, Turin, Florence, Padua, Prato, Bergamo, and Parma.

Why Should You Buy this Research?

- Market size available in the investment, area, power capacity, and Italy colocation market revenue.

- An assessment of the data center investment in Italy by colocation, hyperscale, and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across states in the country.

- A detailed study of the existing Italy data center market landscape, an in-depth industry analysis, and insightful predictions about industry size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in Italy

- Facilities Covered (Existing): 55

- Facilities Identified (Upcoming): 07

- Coverage: 16+ Locations

- Existing vs. Upcoming (Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data center colocation market in Italy

- Market Revenue & Forecast (2022-2028)

- Retail Colocation Pricing

- The Italy market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and the analysis of the demand and supply aspects of the industry.

Major Vendors

IT Infrastructure Providers

- Atos

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Lenovo

- NetApp

- Nutanix

- Oracle

- Pure Storage

Data Center Construction Contractors & Sub-Contractors

- AECOM

- Ariatta

- Eiffage

- EDITEL

- DBA PRO

- Future-tech

- ISG

- In-Site

- NORMA Engineering

- Starching

Support Infrastructure Providers

- ABB

- Alfa Laval

- Caterpillar

- Climaventa Climate Technologies

- Cummins

- Emicon

- Legrand

- HiRef

- Honeywell International

- Piller Power Systems

- Munters

- Mitsubishi Electric

- Pramac

- Rittal

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!