IT Industry Today

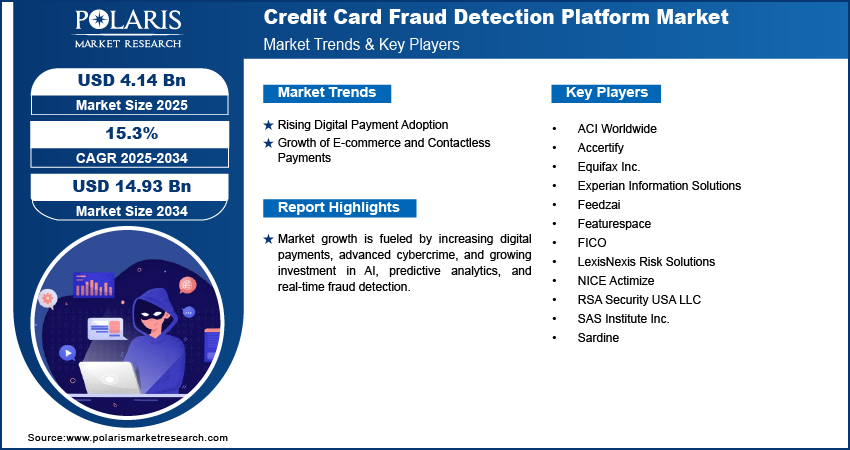

Credit Card Fraud Detection Platform Market Expected to Hit USD 14.93 Billion by 2034 Amid Growing Demand for Advanced Anti-Fraud Solutions

Polaris Market Research has published a brand-new report titled Credit Card Fraud Detection Platform Market Size, Share, Trends, & Industry Analysis Report By Component, By Deployment Model, By Technology, By Application, By End User, and By Region – Market Forecast, 2025–2034 that includes extensive information and analysis of the industry dynamics. The opportunities and challenges in the report's dynamical trends might be useful for the worldwide Credit Card Fraud Detection Platform industry.

The study provides an outline of the market's foundation and organizational structure and forecasts an increase in market share. The study offers a comprehensive analysis of the Credit Card Fraud Detection Platform Market size, present revenue, regular deliverables, share, and profit projections. The study report includes a sizable database on future market forecasting based on an examination of previous data.

Brief About the Report

The global credit card fraud detection platform market was valued at USD 3.59 billion in 2024, expanding at a strong CAGR of 15.3% from 2025 to 2034. Driven by rising digital transactions and increasing fraud incidents, the market is on track to reach USD 14.93 billion by 2034.

The market's supply-side and demand-side Credit Card Fraud Detection Platform Market trends are evaluated in the study. The study provides important details on applications and statistics, which are compiled in the report to provide a market prediction. Additionally, it offers thorough explanations of SWOT and PESTLE analyses depending on changes in the region and industry. It sheds light on risks, obstacles, and uncertainties, as well as present and future possibilities and challenges in the market.

Download PDF Sample of Credit Card Fraud Detection Platform Market:

Key Aspects Covered in The Report

- Overview of fraud detection technologies and AI algorithms

- Market drivers including rise in digital payments and cybercrime

- Segmentation by component, deployment, and organization size

- Analysis of machine learning and real-time analytics adoption

- Regulatory compliance and data protection requirements

- Vendor comparison and competitive landscape

- End-user adoption trends in banking and financial services

- Growth potential and long-term industry outlook

Credit Card Fraud Detection Platform Market Segmentation Analysis

The study offers a thorough analysis of the numerous market segments, including application type, product component, service types, and several geographic locations. The report's segment analysis section contains thoroughly researched expert-verified industry data. Strategic recommendations are given in terms of key business segments based on market estimations.

List of Major Key Players

- ACI Worldwide

- Accertify

- Equifax Inc.

- Experian Information Solutions

- Feedzai

- Featurespace

- FICO

- LexisNexis Risk Solutions

- NICE Actimize

- RSA Security USA LLC

- SAS Institute Inc.

- Sardine

Buy Full Research Report

https://www.polarismarketresearch.com/buy/5475/0

Leading Players Analysis

The research report's chapter is entirely devoted to the competition environment. The Credit Card Fraud Detection Platform Market key players are examined, analyzing information on their evaluation and development in addition to a quick review of the company. Understanding the techniques employed by businesses and the steps they have recently taken to combat intense rivalry allows one to examine the competitive landscape. It covers each player's company profiles comprising sales, revenue, share, recent developments, SWOT analysis, capacity, production, revenue, gross margin, growth rate, and strategies employed by the major market players.

Different potentials in the domestic and regional markets are revealed by regional analysis of the sector. Each regional industry associated with this market is carefully examined to determine its potential for growth in the present and the future. Moreover, information on recent mergers and acquisitions that have taken place in the market is the subject of the research. This section provides important financial information about mergers and acquisitions that have recently shaped the Credit Card Fraud Detection Platform industry.

Regional Analysis

Further, the report goes on to discuss how the Credit Card Fraud Detection Platform Market has grown internationally and across various sectors and regions. The regional analysis included in the study provides information at the regional as well as national level by several market segments. Additionally, the study includes information on the origins of raw materials, downstream consumers, and industrial chain analyses. The forecast analysis section includes vital information on global production and revenue projection, as well as regional forecasts.

Report Summary

The analysis focuses on the regional forecast by type and application and the Credit Card Fraud Detection Platform Market sales and revenue prediction. The research report features data about the target market, such as pricing trends, customer requirements, and competitor analysis. The market growth has been examined using analytical approaches like PESTLE analysis, Porter's Five Forces analysis, feasibility studies, player-specific SWOT analyses, and ROI analyses.

Browse More Information:

https://www.polarismarketresearch.com/industry-analysis/credit-card-fraud-detection-platform-market

The Report Provides You Answer to Below Mentioned Question

Q1. What are the credit card fraud detection platform market statistics?

Ans: The global market was valued at USD 3.59 billion in 2024 and is projected to reach USD 14.93 billion by 2034.

Q2. What is the growth rate of the credit card fraud detection platform market?

Ans: The market is expected to grow at a CAGR of 15.3% during the forecast period.

Q3. Which region dominated the global market share in 2024?

Ans: North America led the market, supported by advanced banking infrastructure, high digital payment adoption, and early integration of AI-enabled fraud detection solutions.

Q4. Who are the key players in the market?

Ans: Key players include FICO, SAS Institute Inc., NICE Actimize, ACI Worldwide, Experian Information Solutions, Feedzai, Featurespace, Equifax Inc., RSA Security USA LLC, LexisNexis Risk Solutions, Accertify, and Sardine.

Q5. Which component segment dominated the credit card fraud detection platform market in 2024?

Ans: The solutions segment held the largest revenue share due to scalable deployment, real-time monitoring capabilities, and widespread adoption by banks, fintechs, and payment processors.

Q6. Which end-user segment is expected to witness the fastest growth?

Ans: The retail & e-commerce segment is projected to grow at the highest rate, driven by increasing online transactions and the adoption of contactless payments.

Objectives of the Report

- To carefully analyze and forecast the size of the market by value and volume.

- To evaluate the market shares of major segments of the market

- To explain the development of the industry in different parts of the world.

- To analyze and study micro-markets in terms of their contributions to the market, their prospects, and individual growth trends.

- To offer precise and valuable details about factors affecting the Credit Card Fraud Detection Platform Market forecasts

- To provide a meticulous assessment of crucial business strategies used by leading companies.

More Related Reports:

Automotive Brake System Market

Calcium Fortified Foods Market

Medical Radiation Shielding Market

About Polaris Market Research & Consulting, Inc:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!