Energy & Environment Industry Today

Coal Price Index Q2 2025: Current Prices, Historical Price Chart and Forecast

North America Coal Prices Movement Q2 2025:

Coal Prices Movement in the USA:

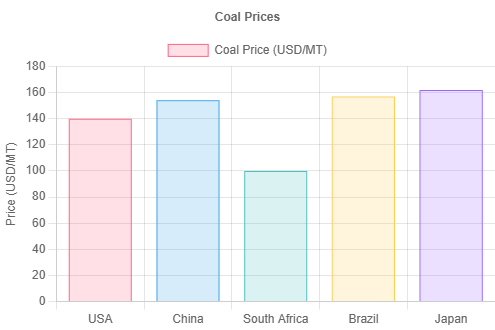

The coal price index in the USA during Q2 2025 averaged around US$ 140/MT. This level was influenced by stable domestic demand from power generation and steel manufacturing. However, transportation delays and labor shortages added moderate supply pressure. Increased focus on alternative energy sources also impacted investment trends, keeping coal market dynamics relatively balanced throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/coal-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

APAC Coal Prices Movement Q2 2025:

Coal Prices in China:

China’s coal prices reached US$ 154/MT during Q2 2025. High industrial activity and energy needs sustained robust demand. Domestic production supported supply, but occasional weather-related mining interruptions and safety inspections caused short-term volatility. Additionally, policy shifts toward emissions control began shaping price expectations across regional markets, contributing to cautious optimism in the coal industry.

Coal Prices in Japan:

Japan recorded an average coal price of US$ 162/MT during Q2 2025. The country’s dependency on imported coal made it vulnerable to global trade fluctuations and freight costs. Steady demand from thermal power and steel sectors supported pricing. Strategic stockpiling and government energy policy further contributed to maintaining a firm price environment throughout the quarter.

Regional Analysis: The price analysis can be extended to provide detailed Coal Prices information for the following list of countries.

China, India, Indonesia, Pakistan, Bangladesh, Japan, the Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hong Kong, Singapore, Australia, and New Zealand, among other Asian countries.

MEA Coal Prices Movement Q2 2025:

Coal Price in South Africa:

During Q2 2025, coal prices in South Africa stood at US$ 100/MT. Strong exports to Asian countries supported the market, despite intermittent rail and port disruptions. Domestic power shortages kept supply tight. Policy uncertainty and logistical hurdles posed challenges, yet affordable mining costs helped maintain moderate pricing within the South African coal export economy.

Regional Analysis: The price analysis can be expanded to include detailed Coal prices information for the following list of countries.

Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries.

Latin America Coal Prices Movement Q2 2025:

Coal Price in Brazil:

Coal prices in Brazil averaged US$ 157/MT in the second quarter of 2025. Demand remained firm from industrial and thermal power sectors. Imported coal played a vital role, given limited local output. Global shipping costs and currency fluctuations influenced price levels, while environmental pressures continued to impact investment in Brazil's coal-based infrastructure.

Regional Analysis: The price analysis can be expanded to include detailed Coal prices information for the following list of countries.

Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries.

Factors Affecting Coal Supply and Prices

Coal prices and supply are shaped by weather disruptions, mining output, transportation delays, and global tensions. Strong demand from power and steel industries, along with energy policies and export restrictions, drive market trends and lead to fluctuating prices across international coal markets.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22476&flag=C

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors influencing the Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, “Coal Price, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition,” presents a detailed analysis of Coal Price trend, offering key insights into global Coal market dynamics. This report includes comprehensive price charts, which trace historical data and highlight major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Coal demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa.

IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!