Chemicals Industry Today

Soda Ash Prices Q2 2025 – Index, Forecast & Price Chart

The Soda Ash Price Trend remained dynamic in Q2 2025, influenced by regional demand fluctuations, raw material costs, and evolving industrial applications. With consistent industrial use across glass manufacturing, chemicals, and detergents, the price of Soda Ash continues to reflect market forces. For businesses seeking clarity, our Soda Ash price index, historical data, and forecast charts offer valuable insights into regional trends and procurement strategies.

Soda Ash Price Trend Analysis

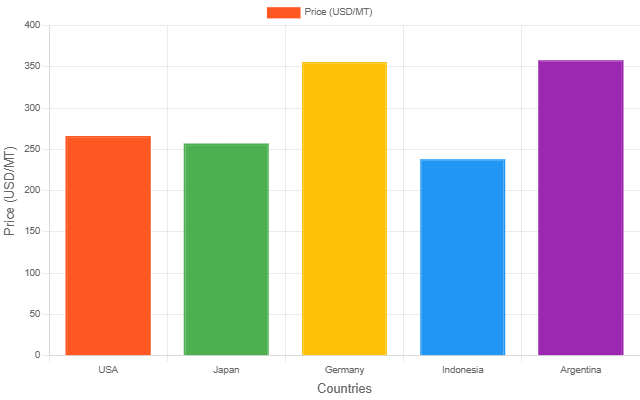

In Q2 2025, Soda Ash prices saw varying trends across regions. The USA reported a moderate dip compared to Q1, while prices in Japan and Germany also softened slightly. However, Argentina and Germany witnessed elevated pricing due to higher energy and transportation costs. The Soda Ash price trend in Asia remained subdued, indicating stable production and lower input pressures. Indonesia experienced the lowest price in March 2025 at US$ 238/MT, showcasing significant regional variation.

Get Real-Time Price Analysis: https://www.imarcgroup.com/soda-ash-pricing-report/requestsample

Soda Ash Forecast

Looking ahead, the Soda Ash future price is projected to remain moderately stable, driven by expected rebounds in global manufacturing. However, energy cost fluctuations and logistics bottlenecks may introduce periodic volatility. Industrial demand in Asia and Latin America is anticipated to strengthen in the second half of 2025, supporting a cautiously optimistic outlook in the Soda Ash price index.

Soda Ash Price Chart & Index

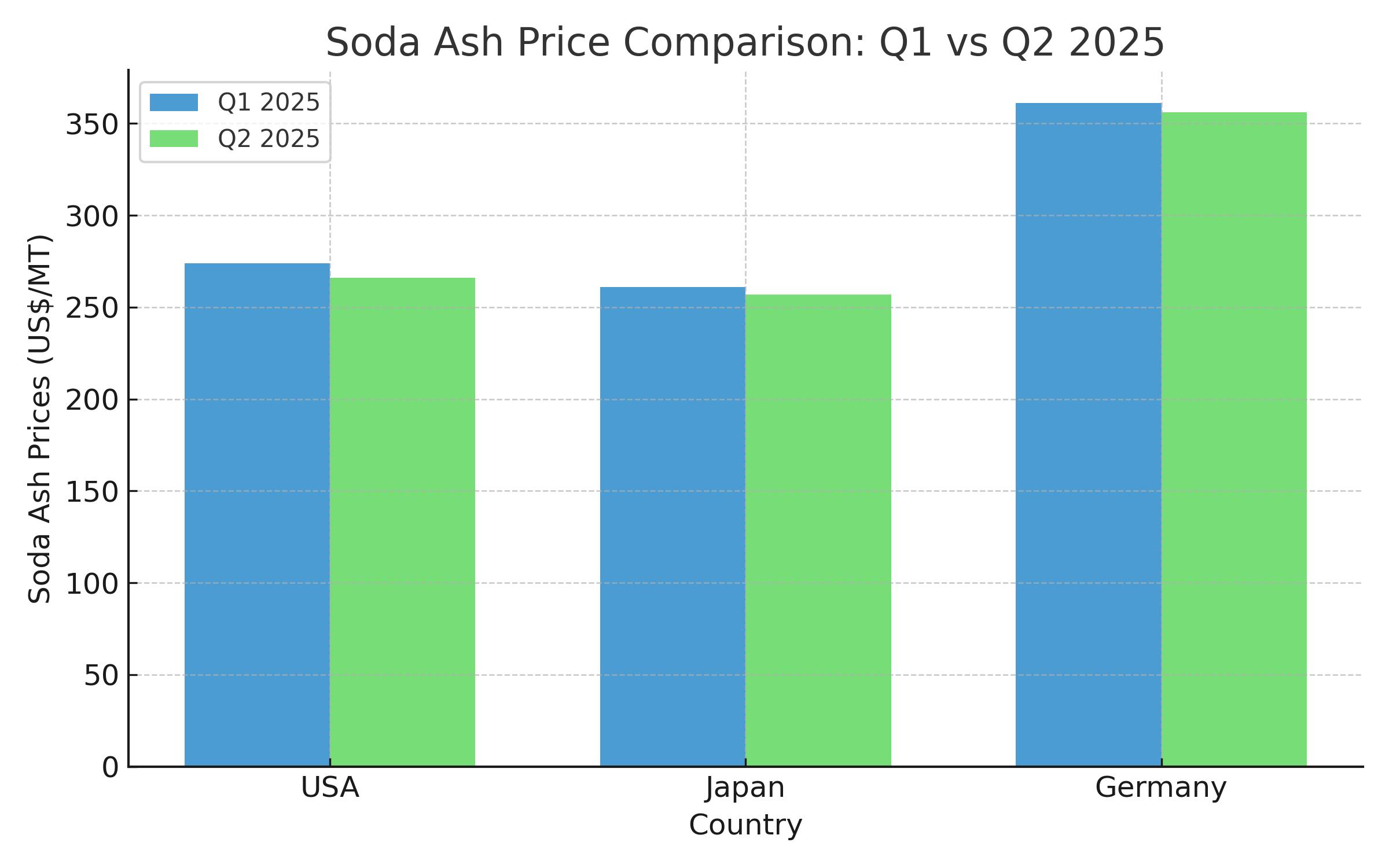

The Soda Ash price chart for 2025 shows moderate quarterly fluctuations with a noticeable dip in Q2. The USA saw a ~3% decrease, while Japan and Germany recorded price drops of around 1.5%–2%. These shifts are reflected in the Soda Ash price index, which aligns with global industrial activity trends and energy input variability. Monitoring the price of Soda Ash through monthly updates and historical graphs is vital for cost planning.

Soda Ash Price Comparison – Q1 vs Q2 2025

Comparative Analysis of Quarterly Price Movement

The Soda Ash prices in Q2 2025 declined slightly compared to Q1. The USA recorded a drop of approximately 3%, Japan saw a decrease of 1.5%, and Germany experienced a marginal decline of nearly 1.4%. This downward trend was attributed to weak demand in end-use sectors and improved inventory levels across global suppliers.

Soda Ash Price History

Reviewing the Soda Ash price history, the market in 2024 exhibited strong growth due to elevated input costs and global supply chain imbalances. In contrast, the first half of 2025 has been comparatively stable, with prices adjusting to reduced energy rates and restored production capacities. A long-term view of Soda Ash price trends highlights cyclical behavior closely tied to industrial and construction sector performance.

Price Trends and Regional Variations

Asia

Indonesia and Japan showcased relatively lower Soda Ash prices, benefiting from local production efficiencies and reduced shipping tariffs.

United States

The USA maintained mid-range pricing, supported by balanced domestic demand and modest export activity. The Soda Ash price today remains competitively aligned with historical benchmarks.

Europe

Germany’s higher prices reflected rising energy tariffs and supply bottlenecks. Europe continues to grapple with higher regulatory and carbon-related operational costs.

Specific Future Trends and Outlooks

- Near Term: Prices may remain soft due to inventory corrections and subdued demand.

- Long Term: Gradual growth anticipated as infrastructure projects pick pace globally.

- Cautiously Optimistic: Stabilization expected in late 2025.

- Potential for Stabilization: Trade normalization could anchor prices.

- Continued Volatility: Geopolitical and energy issues may disrupt pricing trajectories.

Factors Influencing Soda Ash Prices

- Production Costs: Energy and raw material prices heavily impact the price of Soda Ash.

- Supply Chain Disruptions: Port congestion or geopolitical issues affect global availability.

- Market Competition: Competitive pricing in Asia continues to influence global averages.

- Demand: Usage in detergents, glass, and chemicals drives consumption.

Recent Soda Ash Price Trends and Market Activity

- Oversupply: Excess production in some regions is putting downward pressure on prices.

- Weak Demand: Sectors like construction and glass are facing reduced growth.

- Economic Factors: Inflation control measures and tighter credit impact purchasing.

- Regional Differences: Import duties, taxes, and local production affect pricing structures.

- Environmental Regulations: Carbon pricing and emission controls add cost pressures.

- Energy Costs: A direct contributor to fluctuations in the Soda Ash price index.

Historical Trends

- 2024: Soda Ash prices surged in mid-year due to supply limitations.

- 2025: Stabilization observed in Q1 and Q2 with downward price corrections.

News & Recent Development

In recent developments, major manufacturers in the USA and China have announced capacity expansions aimed at capturing export markets in Latin America and Southeast Asia. Additionally, improvements in shipping routes from Asia are expected to lower costs in Q3 2025.

Leading Soda Ash Suppliers

- Tata Chemicals

- Solvay SA

- Ciner Resources Corporation

Browse here for More Realted Report:

· Caustic Soda Price Index Report

· Sodium Sulphate Price Index Report

· Sodium Chlorate Price Trend Report

· Sodium Citrate Price Index Report

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!