Chemicals Industry Today

RBD Palm Oil Prices Q2 2025: Real-Time Price Index, Trends & Forecast

RBD Palm Oil prices continue to play a significant role in shaping global edible oil markets. With key importers like China and India adjusting their procurement strategies and Southeast Asian producers navigating production challenges, RBD Palm Oil Price Forecast 2025 suggests both opportunities and risks. From historical data to real-time trends and regional comparisons, stakeholders can explore how geopolitical shifts, alternative oil pricing, and weather patterns are influencing the price of RBD Palm Oil.

RBD Palm Oil Price Trend Analysis 2025

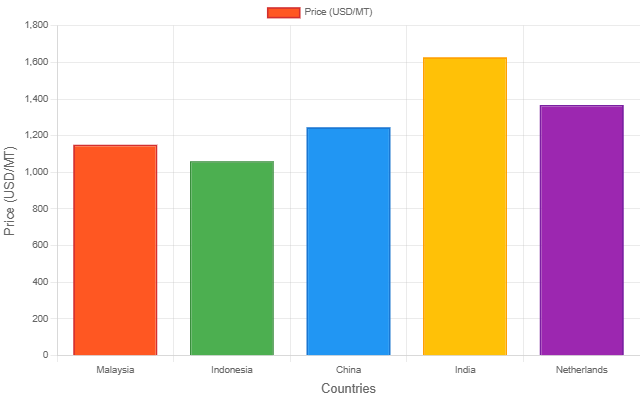

During Q2 2025, RBD Palm Oil prices witnessed moderate fluctuations across major producing and consuming nations. The average price in Malaysia reached US$ 1150/MT, showing a slight rise from Q1. India continued to register the highest regional price at US$ 1627/MT, while Indonesia offered a more competitive rate at US$ 1060/MT. This indicates growing demand in South Asia, supported by lower domestic production of alternative oils.

Get Real-Time Price Analysis: https://www.imarcgroup.com/rbd-palm-oil-pricing-report/requestsample

RBD Palm Oil Price Forecast 2025

The RBD Palm Oil price forecast 2025 projects a cautiously optimistic outlook for the remainder of the year. Increased biodiesel blending mandates in Southeast Asia and rising industrial demand in China are expected to support prices. However, supply chain challenges, climate disruptions, and macroeconomic pressures may moderate upward trends. Long-term price stability will depend on sustainability measures and geopolitical shifts.

RBD Palm Oil Price Chart & Index

The RBD Palm Oil price index is a vital tool for analyzing market movement. In March 2025, the index reflected mild volatility with a gradual upward trend due to increased procurement activity in Asia. The RBD Palm Oil price chart shows sharp seasonal variations, especially between February and April. Monitoring these visual cues helps buyers and investors anticipate procurement windows and manage cost efficiency.

RBD Palm Oil Price History Analysis Data

Historical data from 2024 to 2025 reveals that RBD Palm Oil prices remained resilient despite global uncertainties. In 2024, prices showed a downward trend in Q3 due to surplus production. However, early 2025 saw recovery driven by renewed demand and tighter supply chains. The RBD Palm Oil price history highlights cyclical price behavior closely tied to climate conditions, policy regulations, and global oilseed trends.

RBD Palm Oil Price Comparison | Real-Time

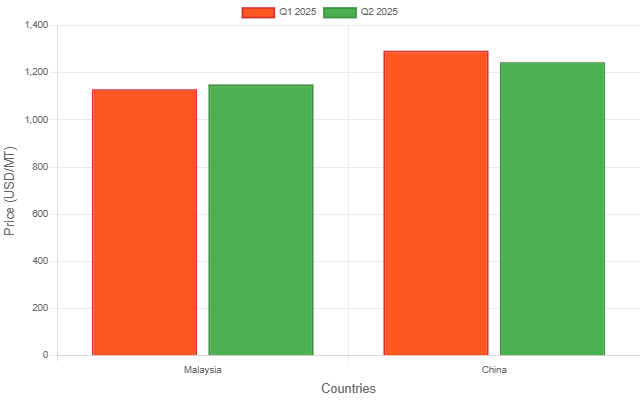

Quarterly Comparison of RBD Palm Oil Prices

The comparison between Q1 and Q2 2025 reveals a marginal increase in Malaysia and a slight drop in China. Specifically, Malaysia saw a nearly 2% rise, while China witnessed a decrease of approximately 3.7% quarter-over-quarter. This shift reflects China's improved domestic inventory and seasonal buying slowdown, while Malaysia benefited from better export sentiment.

List of Key RBD Palm Oil Suppliers

- Wilmar International Limited

- Golden Agri-Resources Ltd

- Sime Darby Plantation Berhad

These companies are some of the most reliable RBD Palm Oil suppliers, offering robust distribution networks and traceable supply chains across Asia and Europe.

Factors Influencing RBD Palm Oil Prices 2025

- Global Supply and Demand: Production forecasts in Malaysia and Indonesia directly impact global supply levels.

- Regional Market Trends: India and China remain key importers, affecting price stability.

- Economic Conditions: Currency fluctuations, inflation, and recession risks in importing countries drive demand shifts.

- Alternative Oils: The price and availability of soybean, sunflower, and canola oils influence RBD Palm Oil future price.

- Government Policies: Tariff changes and import-export restrictions reshape global price dynamics.

- End-User Demand: Food, cosmetic, and biofuel sectors are major contributors to pricing momentum.

Recent RBD Palm Oil Price Trends and Market Activity

March 2025 marked strong buying activity in India and the Netherlands, pushing prices above regional averages. Indonesia maintained competitive pricing to retain export share amid tightening sustainability regulations. The RBD Palm Oil price today shows stable sentiment with a bullish bias due to stockpiling ahead of festival seasons in Asia.

Price Trends and Regional Variations

- India: Highest global price due to high import dependency

- China: Softened in Q2 2025 after strong Q1 import run

- Netherlands: Stable industrial demand supports consistent pricing

Indonesia & Malaysia: Regional price anchors with competitive export offers

Specific Future Trends and Outlooks

- Near Term: Minor corrections expected amid fluctuating demand

- Long Term: Expected steady growth backed by food security and industrial use

- Positive Outlook: Demand in biofuel and FMCG sectors rising

- Potential for Growth: New trade deals and ESG investments encouraging

- Price Spread: Wide disparity between Asia and Europe may widen

- Caution: Weather and inflation risks could disrupt forecast accuracy

Historical Trends

- 2024: Prices dipped in Q3 but recovered moderately by year-end

- 2025: Stable start; Q2 witnessed strong price differentiation across regions

News & Recent Development

Recent updates from the Malaysian Palm Oil Council (MPOC) and Indonesian Palm Oil Association indicate stricter ESG compliance from Q3 2025. Additionally, India has announced a review of its edible oil import duties, which may affect RBD Palm Oil price index in the upcoming quarters.

Browse Here More Other Related Report:

· Biodiesel Price Forecast 2025

· Soybean Oil Price Forecast 2025

· Sunflower Oil Price Forecast 2025

· Tallow Fatty Acid Price Forecast 2025

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!