Chemicals Industry Today

Propylene Carbonate Price Trend Q3 2025: What Global Buyers Should Know

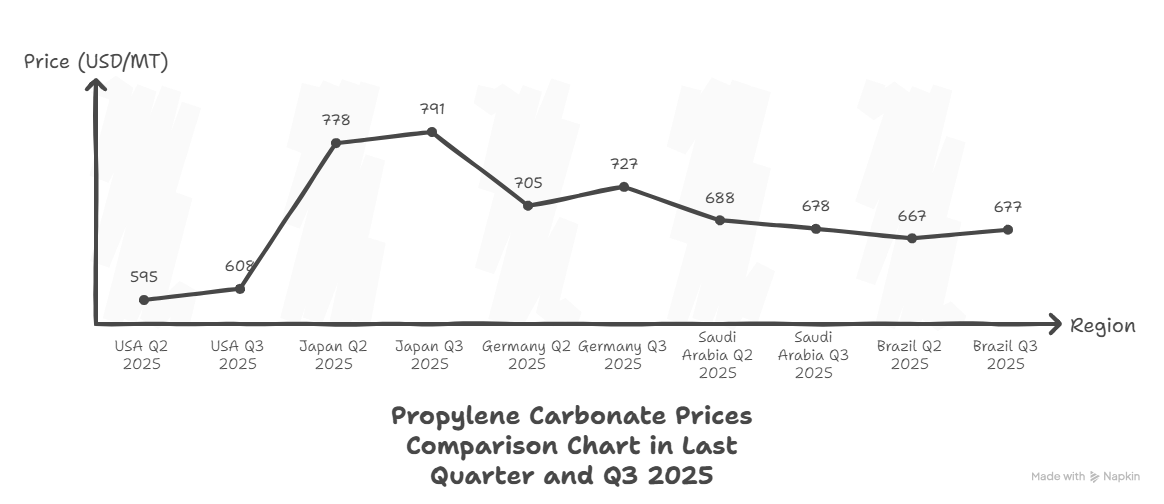

During the third quarter of 2025, Propylene Carbonate Price Trend displayed clear regional divergence, reflecting variations in industrial demand, production economics, and supply availability. In September 2025, prices in the United States reached USD 608/MT, supported by stable consumption from industrial solvent applications. Japan recorded higher prices at USD 791/MT, driven by consistent demand from battery-grade and specialty chemical segments.

In Germany, propylene carbonate prices stood at USD 727/MT, reflecting steady usage across pharmaceutical and high-performance solvent industries. Meanwhile, Saudi Arabia registered prices of USD 678/MT, supported by cost-efficient feedstock access and stable production output. In Brazil, prices closed the quarter at USD 677/MT, indicating balanced demand conditions and controlled supply flows.

Propylene Carbonate Price Trend, Index and Forecast

The Propylene Carbonate Price Trend remains a critical indicator for stakeholders across batteries, chemicals, coatings, and pharmaceutical industries. As a widely used solvent and electrolyte component, monitoring the propylene carbonate price index report helps manufacturers, traders, and investors understand cost movements, supply-demand shifts, and future pricing risks. In 2025, evolving energy markets, expanding battery applications, and regional supply dynamics have reshaped the pricing landscape, making accurate trend analysis increasingly essential.

Propylene Carbonate Price Trend Analysis

Throughout 2025, propylene carbonate prices followed a moderately stable trajectory, with selective upward pressure in regions linked to battery manufacturing and high-purity applications. While industrial solvent demand softened in some markets, growing interest from lithium-ion battery producers provided price support, particularly in Asia and Europe.

The price of propylene carbonate remained sensitive to feedstock cost movements and logistics expenses, but diversified end-use demand prevented sharp volatility. This balance helped stabilize the overall propylene carbonate price index during Q3 2025.

Get Detailed Pricing & Forecast Insights: https://www.imarcgroup.com/propylene-carbonate-pricing-report/requestsample

Propylene Carbonate Price Index, Chart & Current Prices

Analysis of the propylene carbonate price chart shows gradual price normalization following earlier fluctuations. Regions with stronger downstream integration, such as Japan and Germany, maintained premium pricing levels due to demand for high-grade material. Meanwhile, the Americas and Middle East markets reflected cost efficiency and steady supply, keeping prices competitive.

Tracking the propylene carbonate price today against index benchmarks allows buyers to evaluate procurement timing and negotiate supply contracts more effectively.

Propylene Carbonate Price Historical Analysis

Historical pricing data highlights a consistent long-term growth pattern for propylene carbonate, supported by its expanding role in energy storage, electronics, and specialty solvents. Over recent years, prices have shown resilience during periods of broader chemical market volatility, underscoring its strategic importance within the specialty chemicals segment.

Comparing historical trends with current pricing helps businesses assess whether current levels reflect cyclical correction or structural demand growth.

What Factors Determine the Price of Propylene Carbonate?

Several key variables influence propylene carbonate pricing:

- Feedstock availability and cost, particularly propylene derivatives

- Battery and energy storage demand, especially for high-purity grades

- Industrial solvent consumption trends

- Regional production capacity and logistics costs

- Environmental and regulatory compliance requirements

Together, these factors shape both short-term price movements and long-term pricing structures.

What Changed in 2025

The year 2025 marked a shift toward more application-driven pricing. Battery-related demand became a stronger influence, while traditional solvent applications stabilized. Improved supply planning reduced extreme price swings, and buyers increasingly focused on long-term contracts rather than spot purchases.

This shift contributed to a more structured and predictable propylene carbonate future price outlook.

What This Means for Investors and Buyers

For investors, stable price behavior combined with expanding end-use applications signals long-term growth potential in specialty chemicals. For manufacturers and procurement teams, understanding regional price trends enables better sourcing strategies, cost forecasting, and inventory planning.

Monitoring price indices and forecasts is now essential for risk management and budgeting accuracy.

Regional Price Trends and Variations

- North America: Stable pricing supported by industrial solvent demand

- Europe: Firm pricing due to battery, pharmaceutical, and specialty uses

- Asia-Pacific: Premium levels driven by high-purity demand

- Middle East & Latin America: Competitive pricing supported by cost-efficient production

These regional differences highlight the importance of localized market intelligence.

Future Outlook for Propylene Carbonate Prices

Short-Term Outlook

Prices are expected to remain stable through the end of 2025, with limited volatility as supply chains remain balanced and demand growth stays steady.

Long-Term Outlook

Over the longer term, increased adoption of electric vehicles, energy storage systems, and eco-friendly solvents is likely to support gradual price appreciation, particularly for battery-grade propylene carbonate.

Key Highlights of the 2025 Propylene Carbonate Price Trend

- Regional price divergence in Q3 2025

- Strong demand from battery and specialty applications

- Stable supply preventing sharp price volatility

- Positive long-term outlook supported by energy transition trends

News & Recent Developments

Recent developments include capacity optimization by producers, increased focus on high-purity grades, and growing integration with battery supply chains. These trends reinforce propylene carbonate’s strategic importance across multiple industries.

Browse Here Other Related Reports:

- Acetonitrile Price Trend Report

- Dimethyl Sulfoxide (DMSO) Price Trend Report

- Glycol Ether Price Trend Report

- Methyl Ethyl Ketone Price Trend Report

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!