Chemicals Industry Today

HDPE Prices Today: Trend, Index, Chart & Forecast | IMARC

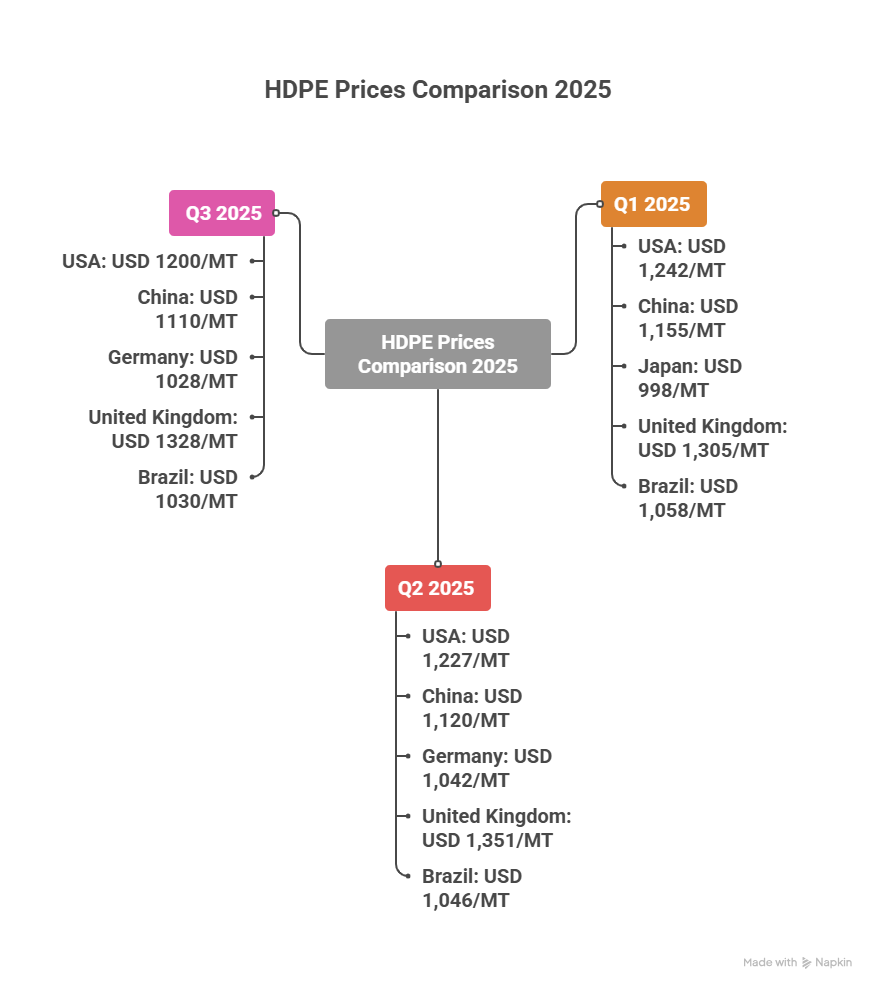

During the third quarter of 2025, High Density Polyethylene (HDPE) prices showed noticeable variation across key global markets, reflecting differences in energy costs, supply conditions, and regional demand. In September 2025, HDPE Price Trend in the USA reached USD 1200/MT, while China recorded USD 1110/MT. In Germany, prices stood at USD 1028/MT, whereas the United Kingdom reported higher levels at USD 1328/MT. Meanwhile, Brazil’s HDPE prices reached USD 1030/MT during the same period.

These regional price differences highlight the importance of tracking HDPE prices closely, especially for manufacturers, traders, and procurement teams involved in packaging, infrastructure, automotive, and consumer goods industries.

HDPE Price Trend Overview

The HDPE price trend is primarily influenced by upstream petrochemical costs, particularly crude oil and natural gas prices, as well as ethylene feedstock availability. During Q3 2025, HDPE prices experienced moderate volatility as energy prices fluctuated and regional supply-demand dynamics evolved.

Demand from packaging applications, including bottles, containers, and films, continued to support prices in several regions. At the same time, infrastructure and pipe-related demand helped stabilize HDPE consumption in emerging markets. Monitoring HDPE price trends enables buyers to anticipate short-term movements and adjust sourcing strategies accordingly.

HDPE Price Index Insights

The HDPE price index serves as a benchmark that tracks average price movements across major global regions. It provides a clear picture of how HDPE prices change over time in response to market conditions.

Movements in the HDPE price index typically reflect:

- Changes in crude oil and natural gas prices

- Ethylene feedstock cost variations

- Operating rates at HDPE production facilities

- Import-export activity and regional trade flows

- Demand shifts from packaging and construction sectors

For procurement professionals, the HDPE price index is a valuable tool for evaluating historical trends, negotiating contracts, and planning purchases more effectively.

HDPE Price Chart and Historical Analysis

A detailed HDPE price chart offers insights into long-term pricing behavior and market cycles. By reviewing historical HDPE price data, buyers can identify periods of price stability, sharp increases, or corrections.

HDPE price history also helps businesses understand how external factors such as energy cost spikes, logistics disruptions, or changes in industrial demand have influenced pricing in the past. This historical perspective is particularly useful for budgeting, cost forecasting, and long-term supply planning.

HDPE Prices by Region

Asia

HDPE prices in Asia are driven by strong demand from packaging, pipe manufacturing, and infrastructure projects. China remains a key market influencing regional pricing due to its large production base and consumption levels.

Europe

In Europe, HDPE prices are shaped by energy costs, regulatory requirements, and reliance on imports. Countries such as Germany and the United Kingdom often experience price differences due to logistics, demand patterns, and supply availability.

North America

HDPE prices in North America depend largely on domestic feedstock availability, plant utilization rates, and demand from industrial and consumer goods applications. The USA remains a major producer and consumer of HDPE globally.

Latin America

In regions such as Brazil, HDPE prices are influenced by import dependency, currency movements, and demand from packaging and construction industries.

Key Factors Affecting HDPE Prices

Several factors collectively determine HDPE prices globally:

- Crude oil and natural gas price fluctuations

- Ethylene feedstock availability and costs

- Production capacity and plant operating rates

- Demand from packaging, pipes, and construction sectors

- Freight, logistics, and supply chain conditions

Understanding these factors allows market participants to better assess price risks and future movements.

HDPE Price Forecast and Outlook

The HDPE price forecast depends on trends in energy markets, planned capacity expansions, and global demand conditions. In the short term, HDPE prices are expected to remain sensitive to feedstock cost changes and regional supply balances. Over the medium term, infrastructure development, packaging demand, and sustainability initiatives are likely to influence HDPE pricing patterns.

Accurate HDPE price forecasts help buyers optimize procurement timing and manage long-term cost exposure.

HDPE Prices vs Alternative Polymers

Buyers often compare HDPE prices with alternative materials to optimize costs. Common comparisons include:

- Polyvinyl Chloride (PVC) Price Trend

- Polystyrene Price Trend

- BOPP Film Price Trend

- Recycled PET Price Trend

Such comparisons help manufacturers evaluate substitution options and manage material costs efficiently.

Access Detailed HDPE Price Data

For updated HDPE prices, regional comparisons, historical trends, price charts, and forward-looking insights, explore the detailed pricing analysis available on this page:

👉 https://www.imarcgroup.com/hdpe-pricing-report/requestsample

This page is designed to support procurement teams, manufacturers, and industry professionals with reliable HDPE price intelligence and actionable insights.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!