Chemicals Industry Today

Green Ammonia Prices Trend Upward Across Regions in 2025 - Latest Report

Global Green Ammonia Prices demonstrated notable changes through 2025 as renewable energy costs, electrolyzer efficiency, and hydrogen supply shaped production economics. The latest Green Ammonia Price Trend Report highlights how Q3 pricing shifted across the USA, Canada, Australia, India, and NW Europe. With more industries adopting clean ammonia technologies, the Green Ammonia price index, historical datasets, and forecast indicators have become essential tools for buyers, investors, and sustainability-driven manufacturers.

Green Ammonia Price Trend Analysis

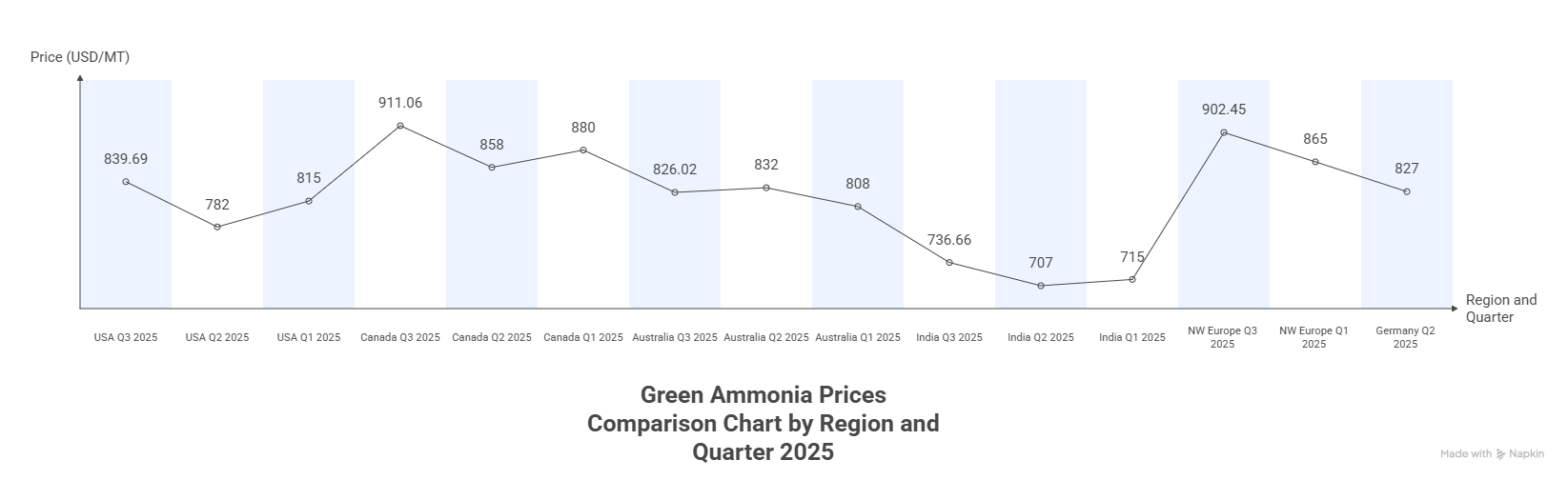

During the third quarter of 2025, Green Ammonia Prices observed upward movement in most regions. The USA reached USD 839.69/MT, while Canada climbed to USD 911.06/MT as renewable power variability influenced conversion costs. NW Europe recorded USD 902.45/MT, supported by strong hydrogen integration programs. Australia and India maintained relatively competitive structures at USD 826.02/MT and USD 736.66/MT, driven by local project economics and renewable availability. These trends emphasize a maturing global clean-fuel ecosystem.

Green Ammonia Price Forecast 2025

Forecast models suggest that Green Ammonia Prices may continue rising moderately as green hydrogen adoption accelerates worldwide. Near-term fluctuations will be driven by renewable energy swings and scaling efficiencies. However, wider electrolyzer deployment and regional energy reforms are expected to bring long-term pricing stability. The industry increasingly uses the Green Ammonia price index to assess procurement risk and plan forward contracts.

Green Ammonia Price Chart & Index

The 2025 Green Ammonia price chart shows gradual price strengthening in advanced economies due to rising hydrogen demand and clean energy policies. Index performance across Q1–Q3 displays heightened volatility in regions with inconsistent renewable energy supply.

Real-time index updates, long-term trend analysis, and chart tools are available at:👉 https://www.imarcgroup.com/green-ammonia-price-trend/requestsample

Green Ammonia Price Historical Analysis Data

A review of Green Ammonia price history reveals that renewable electricity prices have been the biggest determinant of cost structure over recent years. As global carbon policies strengthened, green ammonia gained traction as a clean alternative to conventional ammonia. Historical data shows consistent year-on-year price growth in Europe and North America as supply chains matured and hydrogen hubs expanded.

What Factors Determine the Price of Green Ammonia?

Several key variables influence Green Ammonia Prices, including:

- Renewable electricity availability and tariffs

- Hydrogen production efficiency

- Electrolyzer operating and maintenance costs

- Transportation and storage requirements

- Policy incentives for green hydrogen

- Industrial demand from fertilizers, marine fuels, and energy storage

Each factor plays a significant role in shaping the price of Green Ammonia for both spot and long-term contracts.

What Changed in 2025?

The year 2025 saw new green hydrogen projects go live, expanded maritime ammonia fuel trials, and increased renewable-linked ammonia procurement strategies. Prices rose in regions where renewable energy intermittency narrowed production margins. Meanwhile, emerging economies strengthened domestic supply programs, improving pricing competitiveness and balancing global availability.

What This Means for Investors / Consumers

For investors, stable upward Green Ammonia Prices indicate expansion potential in electrolyzer manufacturing, renewable integration, and maritime fuels. Industrial consumers now rely more heavily on the Green Ammonia price today to optimize inventory cycles and negotiate contracts. With long-term decarbonization pathways aligning across industries, green ammonia is becoming a pivotal clean energy feedstock.

Top Green Ammonia Suppliers Across Regions

- Yara International

- ACME Group

- CF Industries (Green Ammonia Division)

- Ørsted

- Siemens Energy

- Thyssenkrupp Nucera

- Haldor Topsoe

- Air Products Clean Energy

These suppliers contribute significantly to global availability and pricing transparency.

Factors Influencing Green Ammonia Prices

The most significant influences on Green Ammonia Prices include energy sourcing, hydrogen production capacity, ammonia synthesis technology, storage infrastructure, and global demand from fertilizers and shipping. Carbon neutrality targets continue to accelerate project deployment and reshape pricing across major regions.

Regional Price Trends Variations

North America recorded strong price levels driven by high renewable-input costs and infrastructure expansion. NW Europe maintained elevated pricing due to hydrogen corridor development. India reported lower levels, reflecting its favorable renewable cost base. Australia displayed moderate pricing tied to domestic clean-fuel initiatives and scaling electrolysis capacity.

Browse Here for more other Realetd Reports:

Specific Future Trends and Outlooks

Short Term

Short-term trends show moderate price firmness driven by renewable energy variability and early-stage project expansions.

Long Term

Long-term trends indicate steady growth as global shipping, fertilizers, and hydrogen storage industries integrate green ammonia more deeply. Increasing electrolyzer efficiency will help stabilize Green Ammonia Prices beyond 2026.

Key Highlights of the 2025 Green Ammonia Price Trend

- Q3 price increases across USA, Canada, and NW Europe

- Expanding hydrogen-ammonia integration projects

- Renewable electricity volatility affecting pricing

- Strengthening investment pipelines in green fuel technologies

- Improved index transparency for global buyers

News & Recent Development

Recent developments include new green ammonia export terminals in Europe, strategic partnerships for hydrogen-ammonia shipping routes, and regional grants supporting electrolyzer deployment. These initiatives reinforce long-term confidence in stable green ammonia availability.

Quarter-on-Quarter Comparison of Green Ammonia Prices in 2025

Green Ammonia Prices increased steadily from Q1 to Q3 across most regions, reflecting rising green hydrogen utilization and evolving renewable input costs. The USA, Canada, and NW Europe experienced stronger upward movement, while Australia and India displayed more balanced changes aligned with local energy ecosystems.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!