Chemicals Industry Today

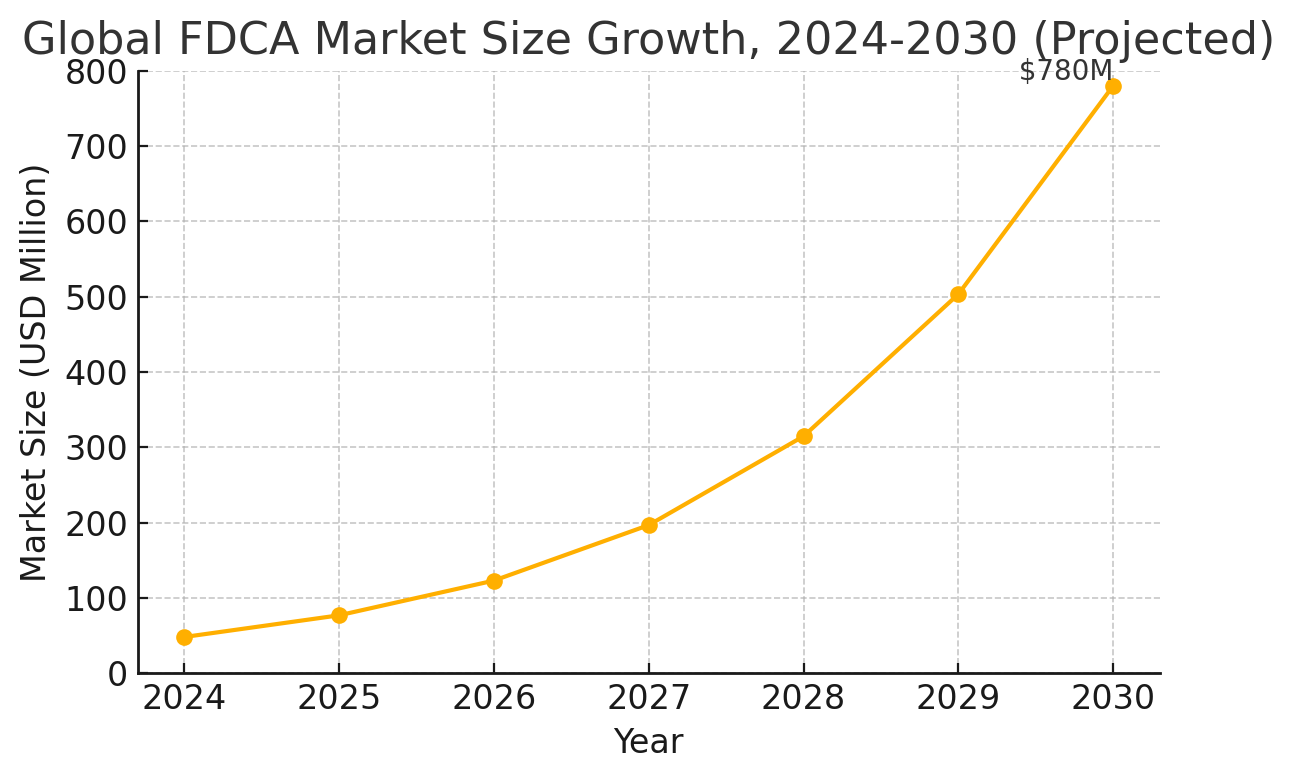

Global FDCA Market to Reach $0.78 Billion by 2030 as Bio-Based Plastics Gain Momentum

Pune, India: The global furandicarboxylic acid (FDCA) market – a cornerstone for next-generation bio-based plastics – is poised for explosive growth. According to a new QYResearch report, the market was valued at only around US$47.8 million in 2024, due to FDCA’s nascent commercial stage, and is now projected to reach approximately US$0.78 billion by 2030. This trajectory represents a ~25%+ compound annual growth rate (CAGR) over the period, underlining investor enthusiasm for sustainable materials. FDCA, a renewable chemical derived from biomass, is emerging as a viable bio-based alternative to petroleum-based terephthalic acid (PTA) in producing plastics like PEF (polyethylene furanoate). Industry stakeholders are increasingly focusing on FDCA as pressure mounts to reduce carbon emissions and shift towards circular, biodegradable packaging solutions.In this market overview, we detail the key drivers, trends, challenges, and competitive landscape shaping the growth of the FDCA industry, alongside segmentation insights by application and region.

Get PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.qyresearch.in/request-sample/chemical-material-global-furandicarboxylic-acid-fdca-market-insights-emerging-trends-and-forecast-to-2031

Key Market Drivers

Several fundamental drivers are propelling the rapid growth of the FDCA market:

Surging Demand for Sustainable Plastics: Manufacturers of plastics and packaging are seeking bio-based, recyclable alternatives to traditional petrochemicals. FDCA is a critical building block for PEF, a next-generation biopolymer with superior barrier properties and recyclability.The need to curb plastic waste and carbon footprint – especially in food and beverage packaging – is driving global FDCA demand.

Regulatory Push and ESG Goals: Governments worldwide are implementing stringent regulations on single-use plastics and carbon emissions, encouraging adoption of renewable materials. Companies face rising environmental, social, and governance (ESG) expectations; many have set sustainability targets that favor bio-based chemicals like FDCA. These policies and corporate sustainability commitments are accelerating market growth by incentivizing the shift to eco-friendly inputs.

Technological Advancements in Production: Ongoing R&D is making FDCA production more efficient and cost-effective. Innovations in biomass conversion and catalytic processes are improving yields and lowering costs. For instance, researchers are developing fermentation and chemical routes to produce FDCA from non-food biomass (e.g. agricultural residues), reducing reliance on expensive sugar-derived intermediates. Such technological strides are gradually overcoming previous economic barriers and enabling scale-up of FDCA manufacturing.

Government and Industry Collaboration: There is growing collaboration between chemical companies, start-ups, and research institutes to commercialize FDCA. Public-private partnerships, pilot plant funding, and knowledge-sharing initiatives are fostering innovation in bio-based polymers. Notably, industry consortiums and government programs in the EU, U.S., and Asia are supporting FDCA development as part of broader bioeconomy and decarbonization strategies. This cooperative ecosystem is helping accelerate FDCA’s journey from lab to market.

Key Market Trends

Beyond the broad drivers above, several specific market trends are shaping the FDCA industry’s evolution:

PEF Poised to Replace PET in Packaging: The most prominent trend is the development of polyethylene furanoate (PEF) – a polyester made from FDCA – as a sustainable replacement for PET in packaging materials. PEF offers improved thermal stability, strength, and gas barrier performance compared to PET, meaning longer shelf life for beverages and food. Major brand owners in the beverage industry are testing PEF bottles and films for their products, attracted by PEF’s recyclability and bio-based origin. This trend of PEF adoption in packaging is expected to dominate FDCA usage in the coming years, aligning with consumer demand for greener packaging.

Shifting Feedstocks: From Food Sugars to Agricultural Waste: Early FDCA production methods relied on converting fructose (from corn syrup or sugar) into HMF (5-hydroxymethylfurfural), then oxidizing HMF to FDCA. However, this sugar-based route raises feedstock cost and food-versus-fuel concerns, potentially impacting global food supply.A key trend is the shift toward non-food biomass sources – for example, deriving FDCA from furfural, which can be made from crop wastes like corn cobs or wood chips. New processes such as carbonylation of furfural (using CO to convert furfural directly to FDCA) are being explored, offering potentially cheaper raw material inputs and improved sustainability.This trend could mitigate raw material bottlenecks and reduce production costs in the long run.

Scale-Up of Production Capacity: After years of bench-scale and pilot projects, the FDCA industry is entering a scale-up phase. Multiple companies have recently built or announced demonstration plants to produce FDCA at tonnage scale. For instance, Avantium (Netherlands) operated a 15-ton pilot in the 2010s and is now nearing completion of a 5,000 ton/year FDCA plant slated to come online in 2024.Similar scale-up efforts are underway in Asia and North America, heralding the transition to commercial-scale FDCA production. As these new facilities come online, global FDCA output will increase dramatically, enabling steady supply for large-volume applications like packaging.

Diversification into Textiles and Specialty Polymers: While packaging is the initial focus, FDCA-based polymers are also making inroads into textiles and other industries. Companies in the polyester and fiber sector are experimenting with PEF and FDCA-derived polyamides to create bio-based textile fibers with improved heat resistance and durability. In Japan, for example, chemical manufacturers have introduced pilot batches of FDCA-based fibers and films for apparel and industrial applications, highlighting growing interest in sustainable textiles. Additionally, FDCA can be used in producing polyurethane foams, coatings, and adhesives, opening opportunities in automotive, electronics, and construction materials. This trend of expanding end-use applications beyond packaging suggests FDCA’s market scope will broaden over time.

Market Challenges

Despite its promise, the FDCA industry faces several key challenges and market resistances that could impact growth:

High Production Costs: Producing FDCA at scale is still significantly more expensive than producing petrochemical alternatives. By weight, bio-based polymers made from FDCA can cost 2–4 times more than conventional plastics.The current processes require costly catalysts, high pressure conditions, and complex separation steps.These factors keep FDCA’s production costs high, making it hard to compete on price with entrenched petrochemical products. Achieving further process efficiency and economies of scale will be critical to reduce costs.

Scaling and Infrastructure Hurdles: Transitioning from pilot scale to commercial production involves large capital investments in new plants and supply chains. Companies must invest in dedicated biorefinery or chemical processing facilities to produce FDCA in bulk, as well as logistics infrastructure to source biomass and distribute the product.For many entrants, securing the financing and navigating the engineering challenges of scale-up pose significant hurdles. Until a robust supply chain is established, FDCA availability will remain limited.

Feedstock Availability and Competing Uses: FDCA’s traditional feedstock, HMF from sugars/starch, ties its production to agricultural commodities. This raises concerns about raw material supply and competition with food crops.If FDCA demand grows rapidly, sourcing sufficient non-food biomass (or developing advanced feedstocks like algae or municipal waste) will be essential. Limited raw material supply is cited as a key restraint by industry analysts.Any volatility in biomass availability or price could slow FDCA’s growth until alternative feedstocks mature.

Product Acceptance and Performance: Polyethylene furanoate (PEF) and other furan-based plastics are not direct drop-in replacements for PET in all contexts.For example, PEF bottles may require design adjustments – they can’t simply be substituted into existing PET bottle manufacturing and recycling streams without modifications.Brands will need to redesign some packaging formats to fully leverage PEF’s benefits. Achieving broad market acceptance will depend on demonstrating that FDCA-based materials can meet or exceed performance requirements in real-world conditions (shelf life, compatibility with recycling systems, etc.). Any performance hiccups or end-user resistance could temper adoption in the near term.

Uncertain Economics at Scale: Because true commercial-scale production is just beginning, there is uncertainty about FDCA’s market price at high volumes. Producers have not yet proven the economics with large plants, leaving questions about how low costs can go with scale. Investors and buyers are seeking clarity on the future price trajectory of FDCA once the first wave of plants is operational. This uncertainty may make some end-users cautious in making long-term commitments until costs stabilize and a track record of large-scale operation is established.

Request Pre-Order Enquiry or Customized Research On This Report: https://www.qyresearch.in/pre-order-inquiry/chemical-material-global-furandicarboxylic-acid-fdca-market-insights-emerging-trends-and-forecast-to-2031

Market Segmentation

The FDCA market can be segmented in several ways, notably by application and by geography. Below we break down the market’s composition and growth areas:

By Application

FDCA’s primary application today is in the production of PEF polymer for packaging materials. Packaging (especially plastic bottles and food containers) is by far the largest end-use segment for FDCA. In fact, PEF currently accounts for roughly 91.6% of FDCA demand,reflecting how dominant the packaging focus is at this early stage. Beverage companies are particularly interested in PEF for bottles, films, and laminates due to its improved gas barrier – which can keep carbonated drinks and foods fresher longer – and its fully recyclable, bio-based profile.

Other applications, while much smaller at present (collectively under 10% of demand) are emerging as FDCA production expands.

Overall, packaging will remain the dominant application in the near- to mid-term, but diversification into textiles and other polymers is expected to accelerate as production volumes rise and companies seek to leverage FDCA’s properties in new areas. The focus for many in the industry is to “find the next PET” – i.e. identify which other large-volume material FDCA can disrupt after PET/PEF, whether in fibers, nylons, or plasticizers.

By Region

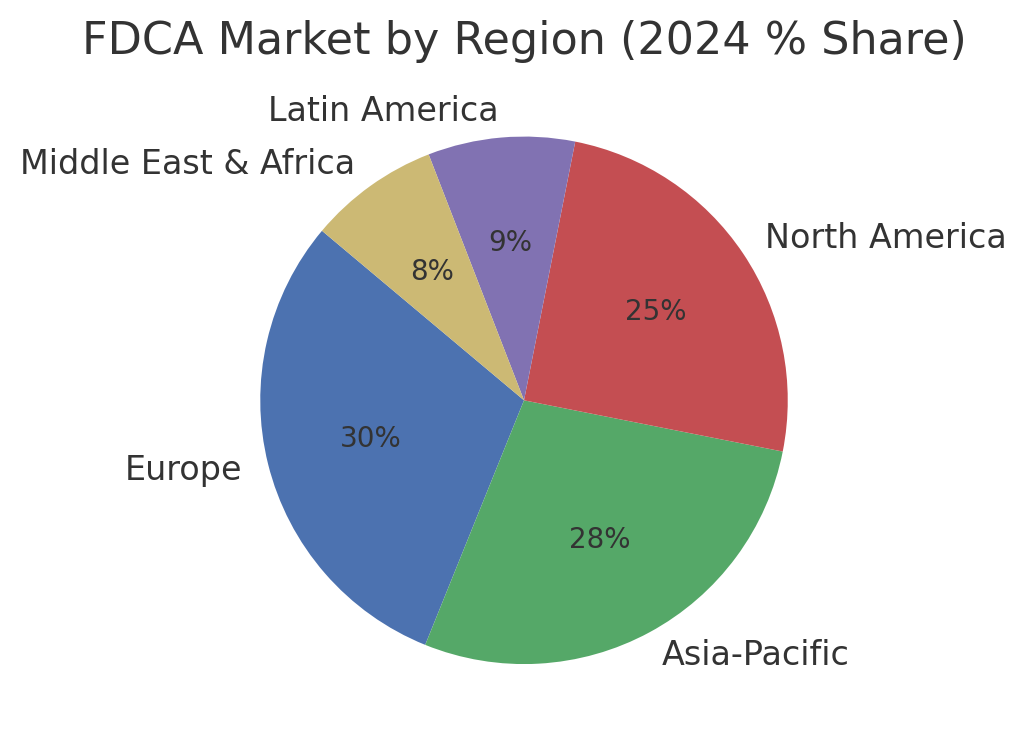

Geographically, FDCA market demand and development activity are spread across North America, Europe, and Asia-Pacific, with Europe slightly ahead in early adoption:

Europe: Europe is at the forefront of the FDCA industry, accounting for an estimated 40–45% of global market share in the early 2020s. This leadership is driven by the EU’s strict environmental regulations, proactive sustainability goals, and early investments in bio-based industries. European innovators were among the first to produce FDCA (for example, the Netherlands is home to key FDCA pilot plants). Strong research initiatives, government funding, and collaboration among chemical companies have positioned Europe as a hub for FDCA development.Europe is also expected to continue growing briskly, with one analysis projecting it to remain one of the fastest-growing FDCA markets through 2030.

North America: North America represents roughly 25% of the FDCA market in 2024.The U.S. in particular is seeing rising demand for bioplastics from major consumer goods brands and ample venture capital investment in green chemistry startups. Regulatory support, such as the USDA BioPreferred Program and various state-level plastic waste mandates, further encourages adoption of FDCA-based materials. North America also boasts strong R&D capabilities – several companies and universities are researching improved FDCA production methods. With initiatives to bolster domestic bio-manufacturing, the region is poised for steady growth. The presence of innovative startups (e.g. Origin Materials) and interest from large chemical companies could see North America expand its FDCA market share in coming years.

Asia-Pacific: Although trailing slightly behind Europe in current usage, Asia-Pacific is the fastest-growing FDCA market. The region holds roughly 20–30% of global FDCA demand today, and this share is expected to surge as manufacturing giants in China, Japan, and other Asian countries adopt bio-based plastics. Asia’s large population and plastic consumption mean there is significant upside if FDCA-based packaging gains traction. Notably, China and India have shown strong willingness to adopt sustainable packaging solutions, supported by government initiatives and rising environmental awareness. Several Asian chemical companies are actively scaling FDCA or PEF production, leveraging abundant biomass resources and growing home markets. Asia-Pacific is thus anticipated to eventually challenge other regions for the top market position, given its combination of demand scale and rapid growth (some forecasts see APAC FDCA demand growing at double-digit CAGR over the next decade).

Latin America and Middle East & Africa: These regions currently comprise a smaller portion of the FDCA market (together under 15% of global share).Latin America (~9%) is led by countries like Brazil and Mexico, where bio-based chemical production is emerging alongside their sizable agriculture industries.There is growing interest in sustainable plastics for packaging and agriculture (e.g. bio-based plastic mulch films) in the region. The Middle East & Africa (~8%) is also nascent but holds long-term potential as petrostate economies diversify and local industries look to adopt renewable materials.Both regions are expected to gradually increase FDCA usage, aided by collaborations with global players and the natural advantage of agricultural feedstock availability in some countries.

In summary, Europe currently leads in FDCA adoption due to policy and innovation, North America maintains a strong position with its R&D and corporate sustainability drive, and Asia-Pacific is the growth engine that will significantly expand FDCA demand. This geographic mix indicates a truly global interest in FDCA, with each region playing a role in scaling this market.

Competitive Landscape

The competitive landscape of the FDCA market is dynamic, characterized by a mix of specialized startups, chemical industry incumbents, and joint venture collaborations. Because FDCA is an emerging market, the industry is still relatively fragmented with numerous players in pilot or early commercial stages.No single company has dominant market share yet; instead, several firms are vying to scale up their technologies and secure partnerships with end-users.

According to QYResearch, the global key manufacturers of FDCA include innovators like Avantium, Leaf Energy (Leaf Biotech), GS Biomaterials, Sugar Energy, CellUranics, Puyang Biomas (Baiaomaisi), Stora Enso, AVA Biochem, Novamont, and Origin Materials, among others.These companies span multiple continents – from Avantium in Europe (a pioneer that developed YXY technology for FDCA production) to biotech startups in China and established renewable materials firms like Novamont in Italy. Each is developing its own route to FDCA (chemical catalysis, fermentation, etc.) and often focusing on specific downstream markets or partnerships. For example, Stora Enso, a forestry products giant, has explored converting wood sugars to FDCA as part of its biomaterials initiative, while Origin Materials (U.S.) is working on converting cellulosic biomass into FDCA and other chemicals.

The market share distribution is still in flux. Industry analyses suggest that the top tier of producers (the leading few companies) collectively account for over 50% of the current FDCA supply-indicating moderate concentration – but as new entrants emerge, the competitive field is broadening. Notably, major chemical companies are also entering or supporting this space through joint ventures and R&D investments. Companies such as BASF, DuPont, Mitsui, and Corbion have either previously partnered on FDCA projects or signaled interest in FDCA-derived polymers (for instance, BASF was an early partner in Avantium’s FDCA venture, and DuPont has researched FDCA-based polyesters). This influx of established players alongside startups is leading to a flurry of collaborations, technology licensing, and scale-up agreements, which is typical for a nascent industry aligning around a new value chain.

Competition in the FDCA market currently centers on mastering efficient production technology and securing downstream offtake agreements. Firms that can achieve high purity FDCA (≥99.9%) at competitive cost will have an edge in capturing customers in the packaging and plastics sector. As of 2024, the 99.9% purity grade FDCA is the most traded, reflecting the stringent quality needed for polymerization into PEF.Companies are also differentiating through their feedstock strategies – for example, those that can utilize non-food biomass or waste feedstocks may achieve cost advantages and better sustainability credentials, attracting eco-conscious brands.

In terms of market ranking, no public revenue figures are available for most producers given the pre-commercial nature. However, Avantium is often regarded as a front-runner due to its extensive patent portfolio and its progress in building commercial capacity. Novamont and Corbion bring strong biopolymer market experience which could translate into competitive positioning as the market grows. Meanwhile, several Chinese companies (e.g., in Henan and Guangdong provinces) have ramped up pilot FDCA production, potentially positioning China as a volume supplier in the future, especially if domestic demand for PEF accelerates.

Overall, the competitive landscape can be summarized as follows: it is an innovation-driven race at this stage, with multiple players attempting to scale up and lower costs. The landscape is expected to consolidate over time – mergers, acquisitions, and partnerships are likely as companies align to pool expertise (already, joint ventures like Synvina (Avantium/BASF) have occurred, and more such alliances could form once large-scale production begins). Investors and stakeholders are advised to watch how cost curves improve and which producers secure long-term contracts with major polymer converters or consumer goods companies, as those will be strong indicators of future market leadership.

For Further insights and Detailed Reports, Visit: https://www.qyresearch.in/report-details/1507482/global-furandicarboxylic-acid-fdca-market

About QYResearch

Founded in 2007 in California, QYResearch is a leading global market research and consulting company with over 17 years of industry expertise. The firm specializes in delivering in-depth market analysis, management consulting, and strategic research across various sectors. QYResearch has a worldwide presence, with a professional research team located in major cities around the globe. The company is renowned for its robust data-driven insights, comprehensive industry reports, and bespoke consulting services that help clients identify non-linear growth opportunities and achieve success.

Contact US

Ankit Jain - Director, Global Digital Marketing

QY Research, INC.

India Office -

315Work Avenue, Raheja Woods, Kalyani Nagar,

Pune, Maharashtra 411006, India

Web – https://www.qyresearch.in

Email- ankit@qyresearch.com

Other Related Report From QY Research:

1. Global Biomass Furan Dicarboxylic Acid (FDCA) Market Insights, Industry Share, Sales Projections and Demand Outlook, 2025–2031

2. Global Bio-based Polyethylene Furanoate (PEF) Market Insights, Industry Share, Sales Projections and Demand Outlook, 2025–2031

3. Global Polyethylene Furanoate Films Market Insights, Industry Share, Sales Projections and Demand Outlook, 2025–2031

4. Global 5-Hydroxymethylfurfural (5-HMF) Market Research Report, Status and Outlook, 2025–2031

5. Global Bio-Based 1,3-Propanediol Market Insights, Industry Share, Sales Projections and Demand Outlook, 2025–2031

6. Global Bio-based 1,3-Butanediol Market Insights — Industry Share, Sales Projections and Demand Outlook, 2025–2031

7. Global Green Polyols Market Insights, Industry Share, Sales Projections and Demand Outlook, 2025–2031

8. Global Polyester Polyol Resin Market Insights, Industry Share, Sales Projections and Demand Outlook, 2025–2031

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!