Chemicals Industry Today

Copper Sulphate Prices Q2 2025 | Trend Report, Index & Forecast

The Copper Sulphate Price Trend Report for Q2 2025 reflects dynamic pricing shifts across major global regions, influenced by industrial activity, agricultural demand, and market logistics. This report covers a deep dive into Copper Sulphate Prices, analyzing trends, historical data, and forecasting upcoming movements with a clear view of the Copper Sulphate price chart, index movements, and market forces.

Copper Sulphate Price Trend Analysis

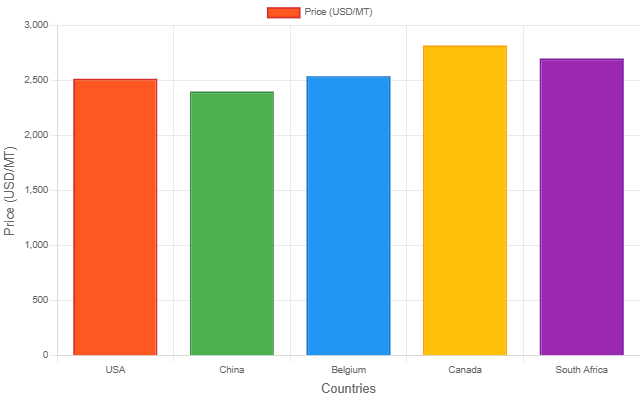

During the second quarter of 2025, Copper Sulphate Prices exhibited moderate increases in key global markets. The USA saw prices reach US$ 2516/MT, while China recorded US$ 2400/MT, showing steady domestic consumption. Belgium and Canada followed similar upward trajectories, indicating strong European and North American demand recovery.

This trend aligns with rising industrial usage and stable agricultural applications, especially in fertilizers and fungicides.

Get Real-Time Price Analysis: https://www.imarcgroup.com/copper-sulphate-pricing-report/requestsample

Copper Sulphate Price Forecast 2025

The Copper Sulphate future price is expected to remain firm in the short term due to persistent demand and limited inventory buildup. With increasing consumption from the agriculture and electronics sectors, the price of Copper Sulphate may continue on a gradual upward trend throughout the latter half of 2025.

However, macroeconomic uncertainties and trade route fluctuations could impact the forecast in select regions. Stakeholders are advised to monitor inventory levels and input costs closely.

Copper Sulphate Price Chart & Index

The Copper Sulphate price index in Q2 2025 reveals moderate yet consistent growth compared to Q1. The Copper Sulphate price chart reflects this increase across regions, notably in North America and South Africa, where industrial rebound and logistics optimization supported the trend.

The global average also rose slightly, indicating broader market strength. Users can access region-specific pricing and historical indices through our full pricing platform.

Copper Sulphate Price Historical Analysis Data

A comparative analysis of the Copper Sulphate price history from 2024 to 2025 reveals a steady recovery in prices after a subdued demand in late 2023. In 2024, prices fluctuated amid input volatility, while in 2025, the market showed stabilization and growth.

This consistency highlights the resilience of Copper Sulphate across industrial applications, especially in mining, printing, and agriculture.

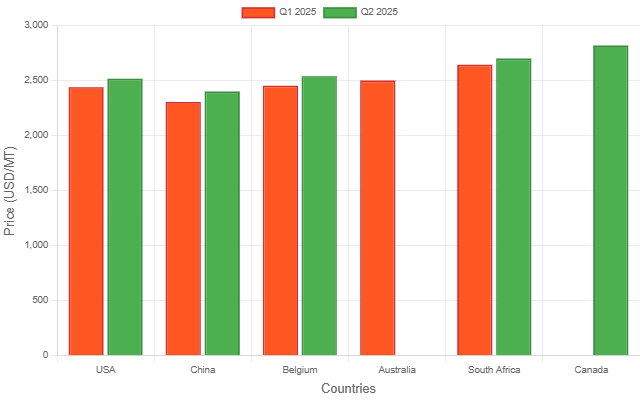

Copper Sulphate Price Comparison : Q1 vs Q2 2025

Across Q1 and Q2 2025, Copper Sulphate Prices in key regions recorded incremental increases. The USA, China, Belgium, and South Africa all experienced percentage gains in pricing due to stronger demand and slightly tightened supply chains. This upward shift is expected to continue if seasonal demand persists in Q3.

Price Trends and Regional Variations

North America: The Copper Sulphate Prices in the USA and Canada rose due to higher agricultural usage and a resurgence in chemical production.

Asia Pacific: China witnessed a moderate increase driven by localized manufacturing growth and post-holiday agricultural activity.

Global: Europe and Africa, particularly Belgium and South Africa, saw significant price action due to export orders and seasonal demand spikes.

Factors Influencing Copper Sulphate Prices

- Raw Material Costs: Fluctuations in copper ore directly impact pricing.

- Industrial Demand: Applications in plating and electronics sustain baseline demand.

- Agricultural Demand: Fertilizer use remains a key driver in Asia and Africa.

- Supply Chain Issues: Shipping delays or congestion affect delivery timelines and costs.

- Seasonal Demand: Planting seasons influence short-term spikes.

- Geopolitical Factors: Tariff changes and trade policies affect cost structure and availability.

Specific Future Trends and Outlooks

Near Term: Slight upward momentum expected due to seasonal planting and steady industrial activity.

Long Term: By early 2026, prices may stabilize with increased global supply unless disrupted by major geopolitical or energy factors.

Historical Trends

- 2024: Characterized by volatile pricing due to supply interruptions and weak global demand.

- 2025: Shows stronger recovery, price stabilization, and positive momentum in key markets.

Recent Copper Sulphate Price Trends and Market Activity

In Q2 2025, global Copper Sulphate Prices rose consistently across all key markets. This was attributed to improved logistics, resumed mining operations, and bulk procurement by fertilizer manufacturers. Additionally, new environmental regulations in some countries have led to changes in sourcing patterns, further shaping pricing.

List of Major Copper Sulphate Suppliers

- Pentagon Chemicals – India

- Mani Agro Chem Pvt. Ltd. – India

- Zibo Dazhong Edible Chemical Co., Ltd. – China

These companies serve as primary suppliers across various continents, catering to both agricultural and industrial segments.

News & Recent Development

- Canada's Agrochemical Firms Increase Imports to meet upcoming Q3 farming cycles.

- China Boosts Domestic Supply via local manufacturers post-lunar season.

- European Union Considers New Tariffs on copper-based chemicals from non-member states.

Browse Here More Other Related Reports:

· Phosphoric Acid Price Trend Report

· Acetic Acid Price Trend Report

· Ammonium Perchlorate Price Trend Report

· Boric Acid Price Trend Report

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!