Chemicals Industry Today

Bromine Price Trend 2025 – Current Prices, Regional Analysis & Forecast

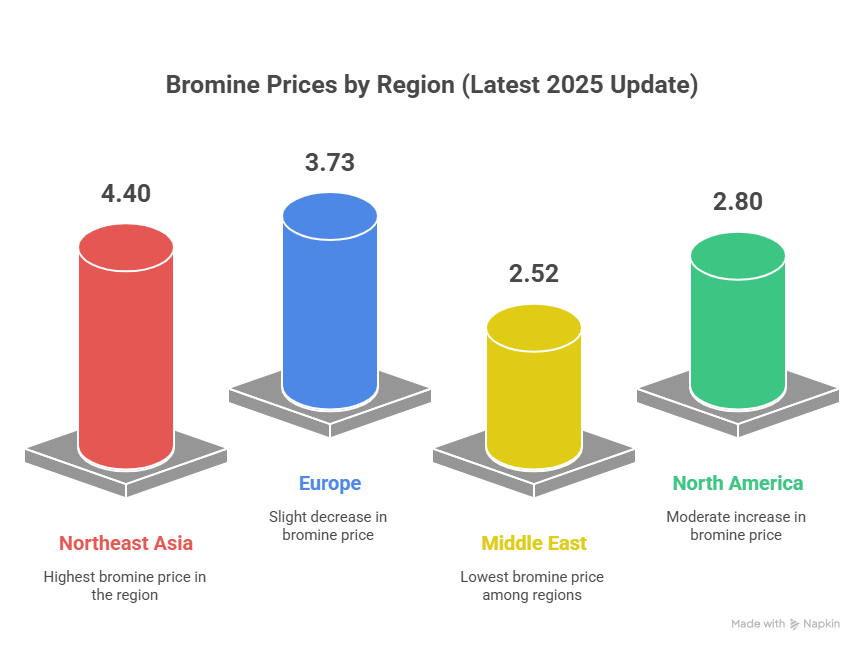

Bromine Prices 2025 – Latest Regional Snapshot

The Bromine Price Trend in last quarter 2025 displayed significant regional variations influenced by supply availability, energy costs, and demand from key end-use sectors such as flame retardants, pharmaceuticals, and oil & gas applications. Manufacturers, chemical distributors, and procurement teams continue to rely on bromine price indexes, historical datasets, and trend analysis for strategic sourcing and cost planning.

Bromine Price Trend Analysis – Regional Insights

Northeast Asia: Prices rose to USD 4.40/KG, supported by tight supply, increased downstream consumption, and elevated energy input costs. Active procurement by electronics and flame-retardant manufacturers reinforced upward momentum.

Europe: Prices declined to USD 3.73/KG with a 3.7% correction, driven by stable inventories, cautious industrial activity, and easing logistics costs.

Middle East: Bromine prices increased to USD 2.52/KG, reflecting cost-efficient extraction and stable production levels. Export demand continues to support pricing in the region.

North America: Prices moved up to USD 2.80/KG, supported by steady demand from oil & gas, water treatment, and pharmaceutical sectors. Disciplined supply management helped maintain pricing stability.

Bromine Price Forecast 2025

The bromine price trend is expected to remain region-dependent. Northeast Asia and North America may continue to witness moderate upward movements if energy and input costs stay elevated. Europe may experience stable to slightly fluctuating prices, influenced by inventory levels and downstream consumption. Businesses are advised to monitor bromine pricing trends closely for effective procurement and contract planning.

Bromine Price Chart & Index Overview

The bromine price chart for 2025 demonstrates moderate regional volatility, primarily driven by energy input fluctuations, downstream demand, and supply discipline. The bromine price index offers a reliable benchmark for buyers and sellers to gauge historical trends and anticipate future movements.

Request Your Bromine Pricing Report: https://www.imarcgroup.com/bromine-pricing-report/requestsample

Historical Bromine Price Analysis

Bromine price history shows periodic fluctuations over recent years due to variations in industrial demand, production costs, and global energy prices. Since 2021, rising use in pharmaceuticals, flame retardants, and drilling fluids has contributed to consistent regional price support. Historical trends also underline the link between energy costs and bromine production economics.

Factors Determining Bromine Prices

Key influences shaping bromine pricing include:

- Regional supply and production efficiency

- Energy costs, especially natural gas and electricity

- Feedstock costs including chlorine and sulphur

- Demand from pharmaceuticals, oil & gas, and flame-retardant sectors

- Export-import regulations and regional trade dynamics

What Changed in 2025?

- Supply tightness in Northeast Asia and North America drove price increases.

- Europe saw moderate corrections due to steady inventories.

- Middle East maintained competitive pricing thanks to efficient production.

- Rising energy costs and derivative demand influenced regional variations.

What This Means for Buyers & Investors

Accurate bromine pricing intelligence helps:

- Optimize sourcing and procurement strategies

- Track regional pricing differences for import/export decisions

- Forecast costs for downstream chemical production

- Structure contracts using the bromine price index

Top Bromine Suppliers Across Regions

- Albemarle Corporation

- ICL Group (Israel Chemicals)

- Lanxess Bromine Division

- Tosoh Corporation

- Shandong ENFI Engineering & Chemical Co.

Regional Price Trends & Variations

- North America: Supported by steady downstream consumption and energy-linked cost pressure.

- Northeast Asia: High pricing due to supply tightness and firm export demand.

- Europe: Price correction amid stable inventories and lower industrial uptake.

- Middle East: Competitive pricing maintained through efficient production and resource availability.

Specific Future Trends and Outlook

Short-Term: Bromine prices will continue to reflect seasonal demand, energy costs, and regional supply variations.

Long-Term: Steady growth expected as demand from pharmaceuticals, flame retardants, and oil & gas applications increases. Energy cost management and efficient production will remain key determinants.

Key Highlights of the 2025 Bromine Price Trend

- Strong Q3 performance in Northeast Asia and North America

- Competitive pricing in Middle East supports sourcing opportunities

- Europe shows mild downward adjustment due to inventory stability

- Energy input and feedstock costs continue to influence regional pricing

- Historical and forecast analysis aids in procurement and investment decisions

News & Recent Developments

Recent updates include expansions of bromine production facilities, adoption of energy-efficient extraction techniques, and strategic supply partnerships in Asia and North America. These initiatives aim to stabilize supply, enhance production efficiency, and provide reliable pricing insights for global buyers.

Related Reports

- Chlorine Price Trend Report

- Natural Gas Price Trend Report

- Crude Oil Price Trend Report

- Sulphur Price Trend Report

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!