Construction Industry Today

Stainless Steel Prices Update 2025: Get Latest Index & Forecast Now

Stainless Steel Prices in Northeast Asia: Latest 2025 Index Overview

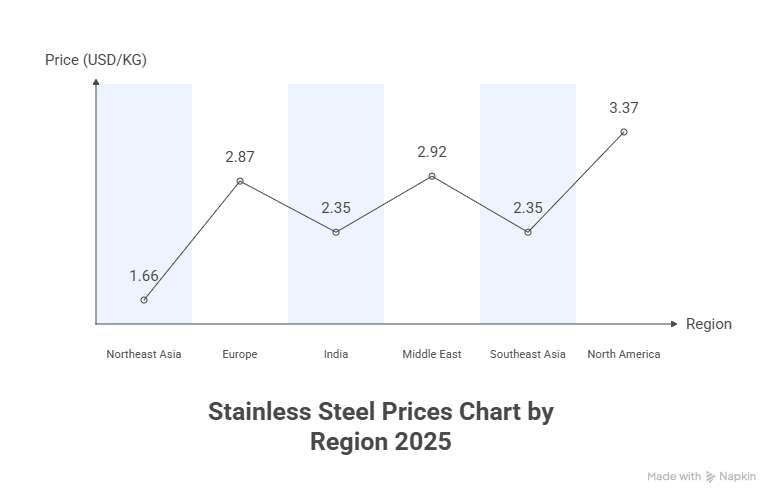

Northeast Asia’s stainless steel price declined to USD 1.66/kg, reflecting softer demand and modest adjustments in raw material sourcing. According to Stainless Steel Historical Price Analysis, the region often experiences cyclical dips during production slowdowns. The Stainless Steel Price Trend Report 2025 suggests mild recovery ahead as industrial activity strengthens and supply chains stabilize across key manufacturing hubs.

Regional Analysis: The price analysis can be extended to provide detailed Ascorbic Acid price information for the following list of Northeast Asia regions.

China, Japan, South Korea, North Korea, Mongolia, among other Asian countries.

Stainless Steel Prices in Europe: Latest 2025 Index Overview

Europe recorded a drop to USD 2.87/kg, influenced by reduced stainless steel consumption and caution among downstream industries. Insights from Stainless Steel Historical Price Analysis show Europe’s pricing frequently reacts to energy costs and alloy surcharges. As per the Stainless Steel Price Trend Overview 2025, a gradual rebound is anticipated once inventory corrections ease and production outlooks improve.

Regional Analysis: The price analysis can be extended to provide detailed Ascorbic Acid price information for the following list of European regions.

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Stainless Steel Prices in India: Latest 2025 Index Overview

India’s stainless steel prices fell to USD 2.35/kg amid moderated demand and changes in raw material accessibility. Stainless Steel Historical Price Analysis indicates India’s pricing patterns often track domestic construction trends and nickel fluctuations. The Stainless Steel Price Trend Overview 2025 points toward steady stabilization as infrastructure projects pick up pace and local production balances supply.

Note: The analysis can be tailored to align with the customer's specific needs.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/stainless-steel-pricing-report/requestsample

Stainless Steel Prices in Middle East: Latest 2025 Index Overview

The Middle East reported a slight decrease to USD 2.92/kg, driven by controlled procurement and slower industrial output in select sectors. Based on Stainless Steel Historical Price Analysis, this region typically sees limited volatility due to consistent import channels. The Stainless Steel Price Trend Overview 2025 suggests moderate improvement supported by large-scale development initiatives and increasing reliance on durable alloy products.

Regional Analysis: The price analysis can be extended to provide detailed Stainless Steel price information for the following list of Middle East regions.

Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain, Iraq, Iran, Israel, Jordan, Lebanon, Syria, and Yemen, among other Middle East regions.

Stainless Steel Prices in South East Asia: Latest 2025 Index Overview

Southeast Asia’s stainless steel price slipped to USD 2.35/kg, impacted by softer manufacturing activity and adjustments in export-led production. Through Stainless Steel Historical Price Analysis, pricing in this region is known to fluctuate with shifts in regional nickel supply. The Stainless Steel Price Trend Overview 2025 anticipates gradual strengthening as demand from fabrication and processing segments recovers.

Regional Analysis: The price analysis can be extended to provide detailed Stainless Steel price information for the following list of Southeast Asia regions.

Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore, Myanmar, Cambodia, Laos, Brunei, and Timor-Leste, among other Southeast Asia regions.

Stainless Steel Prices in North America: Latest 2025 Index Overview

North America posted the highest price at USD 3.37/kg, with only a minor decline, indicating relatively stable stainless steel consumption. Stainless Steel Historical Price Analysis highlights how U.S. pricing steadiness often stems from strong industrial requirements and balanced inventories. In the Stainless Steel Price Trend Overview 2025, analysts expect firm pricing supported by ongoing manufacturing resilience and controlled supply adjustments.

Regional Analysis: The price analysis can be extended to provide detailed Stainless Steel price information for the following list of North America regions.

United States, Canada, and Mexico, among other North America regions.

Stainless Steel Price Trend, Index, History, and Forecast – 2025

Stainless Steel prices declined across regions in November 2025, with Northeast Asia at 1.66 USD/KG (-3.3%), Europe at 2.87 USD/KG (-5.7%), India at 2.35 USD/KG (-3.9%), Middle East at 2.92 USD/KG (-1.6%), Southeast Asia at 2.35 USD/KG (-4.9%), and North America at 3.37 USD/KG (-0.2%). This broad downward shift stems from softening construction and manufacturing demand alongside nickel oversupply easing production costs.

Current News and Price Trend

- Northeast Asia led declines due to weak Chinese real estate and infrastructure investment, offset partially by eased Indonesian nickel quotas and stronger local currencies lowering import expenses.

- Europe saw sharp drops despite brief September upticks from trade protections, as high energy costs clashed with sluggish construction, autos, and consumer goods sectors.

- North America edged lower on cautious inventory strategies in construction and automotive end-uses, with stable mill output and falling nickel/chromium prices adding downward pressure.

- India and Southeast Asia mirrored the pattern, hit by infrastructure slowdowns, monsoon logistics hurdles, elevated trader stocks, and volatile fuel/power costs prompting discounts.

Key Factors Shaping the Price Index

- Nickel and Chromium Costs: Global oversupply, particularly Indonesia's nickel pig iron exports, reduced input expenses and squeezed mill margins.

- End-User Demand Slump: Delayed capex in construction, real estate, and autos built inventories, forcing sellers to offer concessions amid economic uncertainty.

- Energy and Regulatory Pressures: Europe's high utilities and compliance charges sustained cost bases, while Asia benefited from relatively stable power despite environmental fees.

- Logistics Bottlenecks: Persistent port delays, fuel swings, and inland transport issues inflated landed costs, though sequential improvements curbed broader impacts.

- Currency Dynamics: Asian currency strength cut USD-denominated raw material bills; weaker ones in import-heavy zones amplified expenses.

Recent Regional Developments Affecting Price Trend

- Northeast Asia: Demand weakness in downstream sectors combined with raw material relief, though domestic energy and logistics kept overheads notable.

- Europe: Limited high-cost capacity and import curbs offered fleeting support, but macroeconomic hesitancy in key sectors drove net softening.

- India: Rising rates and inflation stalled infrastructure pulls; rupee volatility and seasonal transport woes spurred stock clearances.

- Middle East: Oil/gas projects provided pockets of firmness against construction drags, with freight duties and subsidies influencing balances.

- North America/Southeast Asia: Adequate supply from mills/imports met subdued orders, extending corrections amid global benchmark easing.

Historical Price Pattern

Early 2025 featured volatility from nickel surges and tighter supply, stabilizing Asia around 1.80-2.00 USD/KG. Mid-year cooling post-infrastructure highs pulled Europe/North America down 5-10% into Q3. November's 1.6-5.7% drops extended an 8-10% annual retreat from 2024 peaks, tied to excess capacity.

Stainless Steel Price Forecast and Outlook

The sector hit USD 163.7 Billion in 2025, targeting USD 261.5 Billion by 2034 at 5.04% CAGR, fueled by construction, autos, and energy resilience. Near-term trends hold downward to flat through Q1 2026 amid oversupply, but nickel rebounds ($15,000–20,000/MT), US/EU tariffs, and Chinese curbs could spark modest H2 recovery—stronger in protected regions, lagging in Asia. Watch EV infrastructure and trade policies for pivots.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22297&flag=C

What Changed in 2025

In 2025, stainless steel pricing shifted due to softer global demand, fluctuating nickel costs, and tighter energy-related production budgets. Inventory corrections across major regions also pushed values downward, creating a more cautious purchasing environment compared with previous years.

How to Negotiate Better Stainless Steel Pricing in 2025

Buyers can secure better stainless steel pricing by leveraging long-term contracts, diversifying suppliers, monitoring nickel movements, and timing purchases during inventory corrections. Strengthening relationships with mills and using credible pricing intelligence also enhances negotiation leverage throughout 2025.

Current Industry News and Emerging Trends in Stainless Steel Pricing

Recent updates in 2025 show stainless steel prices softening as global nickel values retreat and production efficiency improves across major regions. Several mills announced output adjustments to balance inventories, while ongoing sustainability regulations continue shaping alloy preferences. These developments influenced short-term pricing and signaled a shift toward more stable cost patterns.

Browse Here More Other Related Reports:

- Steel Price Trend Report

- Stainless Steel (316) Price Trend Report

- Hot Rolled Steel Coil Price Trend Report

- Flat Steel Price Trend Report

How IMARC Pricing Database Can Help

The latest IMARC Group study, Stainless Steel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition, presents a detailed analysis of Stainless Steel price trend, offering key insights into global Stainless Steel market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Stainless Steel demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Share on Social Media

Other Industry News

Ready to start publishing

Sign Up today!